Latest M&A Statistics for Q2 2021

The UK Office for National Statistics have just released their latest data for Mergers and Acquisitions involving UK companies for Q2 2021, during the period April to June 2021.

Statistics for Q2 2021 Headlines

In Q2 (Apr-Jun) 2021 the value of cross-border and domestic mergers and acquisitions (M&A) involving a change in majority share ownership recorded notable increases.

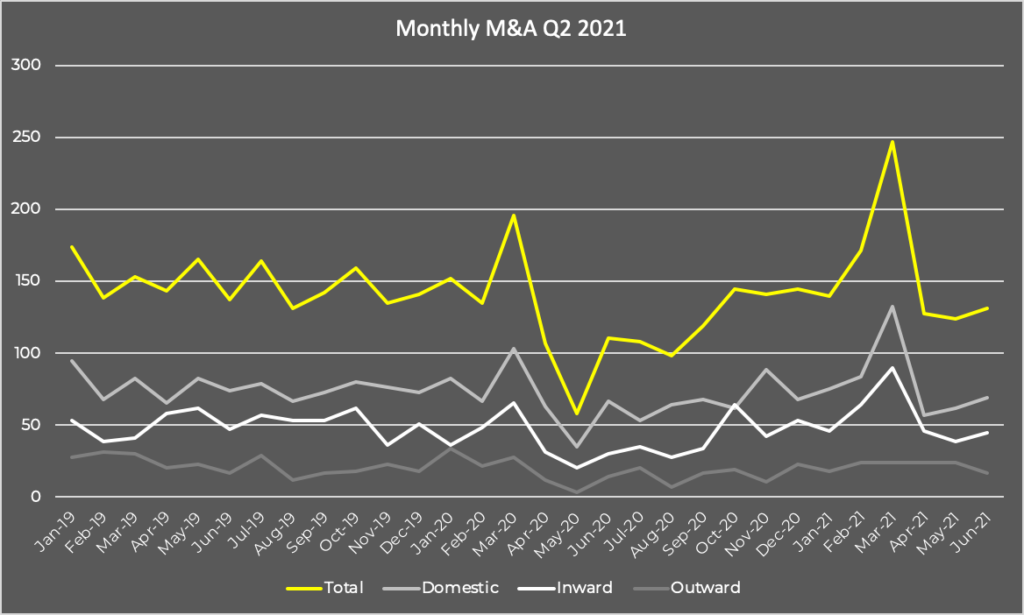

The total number of monthly cross-border and domestic deals fell to a low of 58 in May 2020 as the coronavirus (COVID 19) pandemic affected the amount of M&A activity; thereafter, monthly M&A activity increased reaching a peak in March 2021 (246) before falling considerably to 127 in April 2021 and continuing around that level to June 2021 (131).

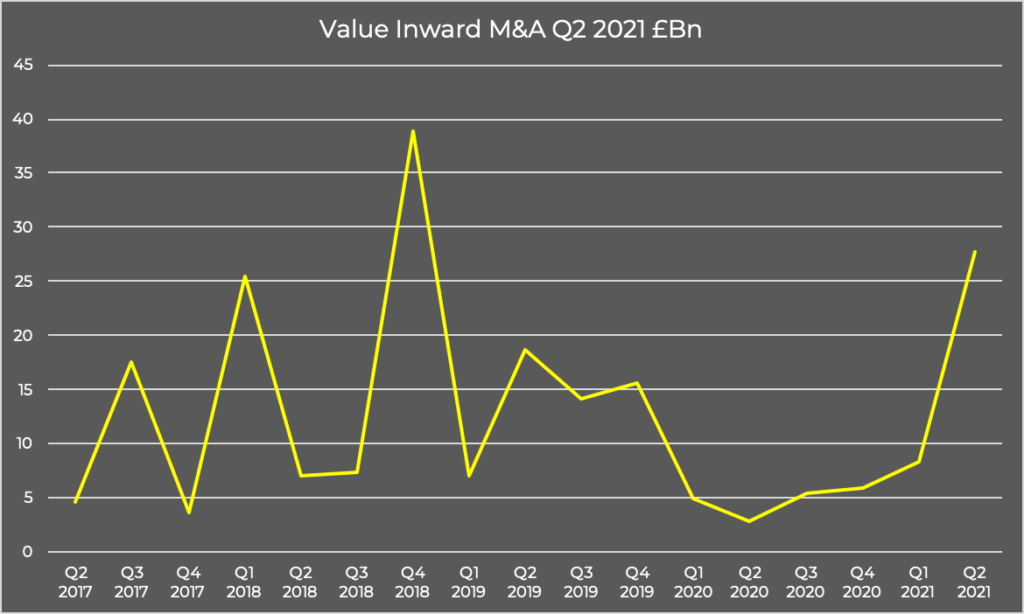

In Q2 2021 the total value of inward M&A (foreign companies abroad acquiring UK companies) was £27.7 billion, £19.4 billion higher than Q1 (Jan-Mar) 2021 (£8.3 billion).

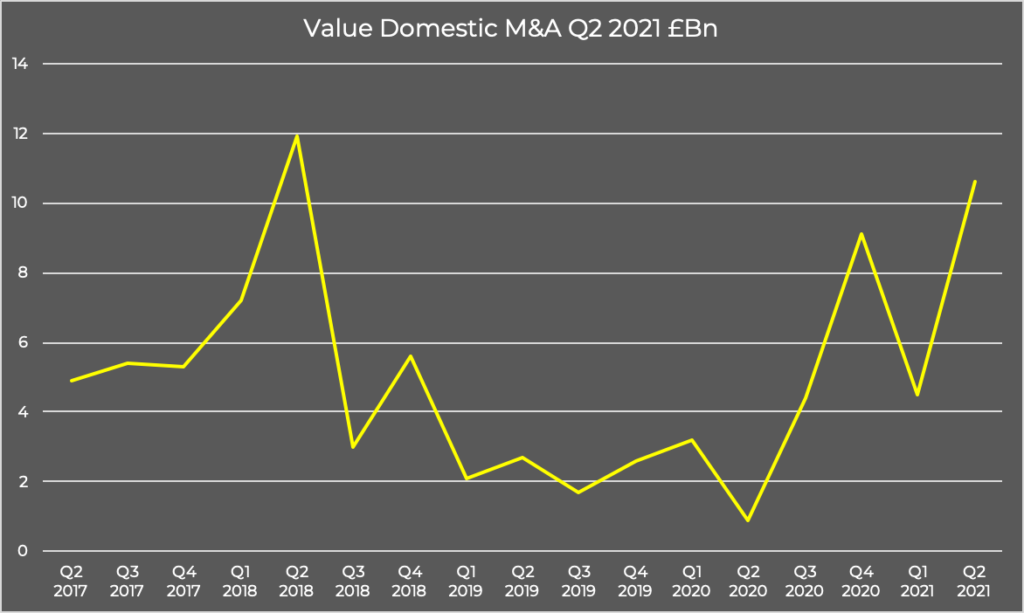

The value of domestic M&A (UK companies acquiring other UK companies) was £10.6 billion in Q2 2021, an increase of £6.1 billion on the value recorded in the previous quarter (£4.5 billion).

Outward M&A (UK companies acquiring foreign companies abroad) was valued at £6.0 billion in Q2 2021, £4.3 billion higher than the previous quarter (£1.7 billion).

Monthly M&A Q2 2021

The number of monthly M&A deals involving UK companies fell from a peak of 246 in March 2021 to 131 in June 2021.

M&A activity has been affected by the global coronavirus (COVID-19) pandemic. As such, the total number of completed monthly domestic and cross-border deals rapidly fell to a low of 58 in May 2020. After the fall, M&A activity started to recover with an upward trend to a new peak of 246 in March 2021 – the highest of all months from the data beginning January 2019. However, in April 2021 there was a sizeable decrease compared with March 2021 (246 to 127). This level continued to June 2021, which had a total of 131 completed transactions.

Domestic M&A saw a significant decrease of 71 deals between March 2021 (132) and April 2021 (57) before seeing a slight increase to June 2021 (69).

Similarly, inward M&A also decreased between March 2021 (90) and May 2021 (38), then increased during June 2021 (45).

The monthly number of outward M&A has followed a relatively flat trend since December 2020 (23) to June 2021 (17).

The Bank of England’s Agents’ summary of business conditions report for Q2 2021 comments: “During the early stages of the pandemic in 2020, economic activity fell at an unprecedented pace… more recently, economic activity has recovered as social distancing restrictions have been lifted.”

Inward M&A Q2 2021

Inward M&A during Q2 (Apr-Jun) 2021 were valued at £27.7 billion. This was a sizeable increase of £19.4 billion on the previous quarter (£8.3 billion) and £24.9 billion more than the value of £2.8 billion in Q2 2020.

Two notable inward acquisitions that completed in Q2 2021 were:

- Intact Financial Corporation of Canada acquired RSA Insurance Group Limited of the UK, read press release

- Atlas Ontario LP of Canada acquired G4S Plc of the UK, details here

Number Inward M&A Q2 2021

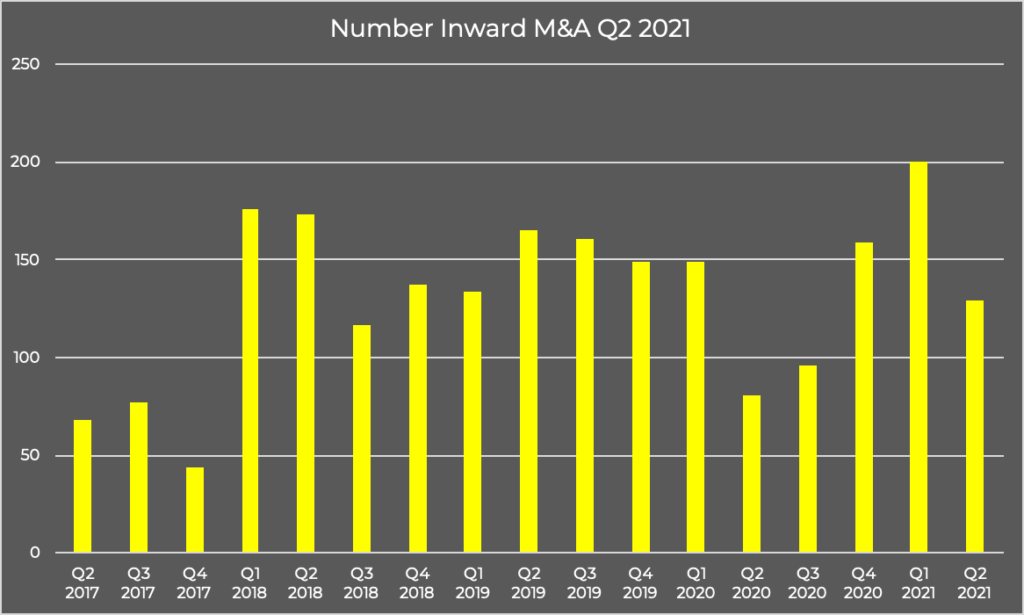

In Q2 2021 there were 129 completed inward M&A deals, a decrease of 71 on the previous quarter (200), although a notable increase of 48 acquisitions when compared with Q2 2020 (81).

Value Domestic M&A Q2 2021 £Bn

The value of domestic M&A involving a change in majority share ownership in Q2 (Apr-Jun) 2021 was £10.6 billion, £6.1 billon higher than the previous quarter (£4.5 billion) and a £9.7 billion increase on Q2 2020 (£0.9 billion).

Two notable domestic acquisitions that completed in Q2 2021 were:

- National Grid Plc acquired PPL WPD Investments Ltd, read press release

- Pennon Group Plc acquired Bristol Water Holdings UK Ltd, more here

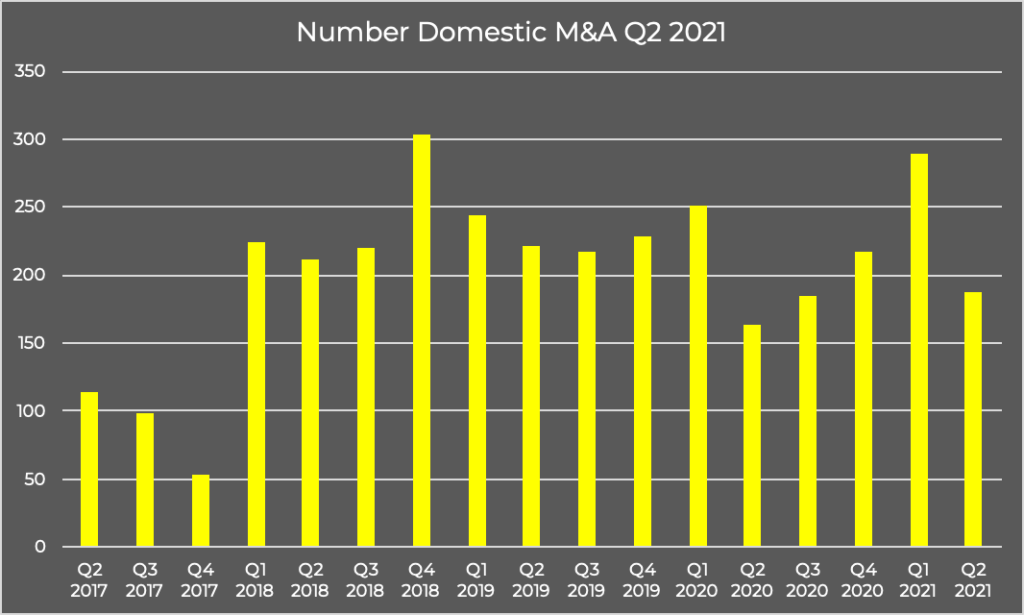

Number Domestic M&A Q2 2021

There were 187 completed domestic M&A during Q2 2021,103 fewer than the previous quarter when 290 acquisitions were recorded and 23 additional acquisitions than recorded in Q2 2020 (164).

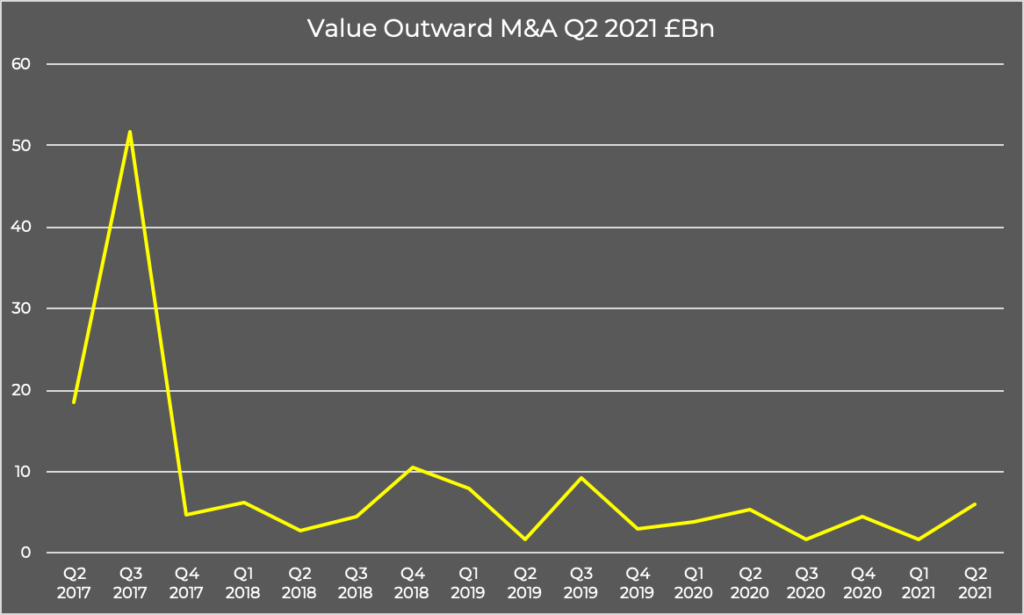

Value Outward M&A Q2 2021 £Bn

In Q2 (Apr-Jun) 2021 the value of outward M&A involving a change in majority share ownership was £6.0 billion, £4.3 billion higher than recorded in the previous quarter (£1.7 billion).

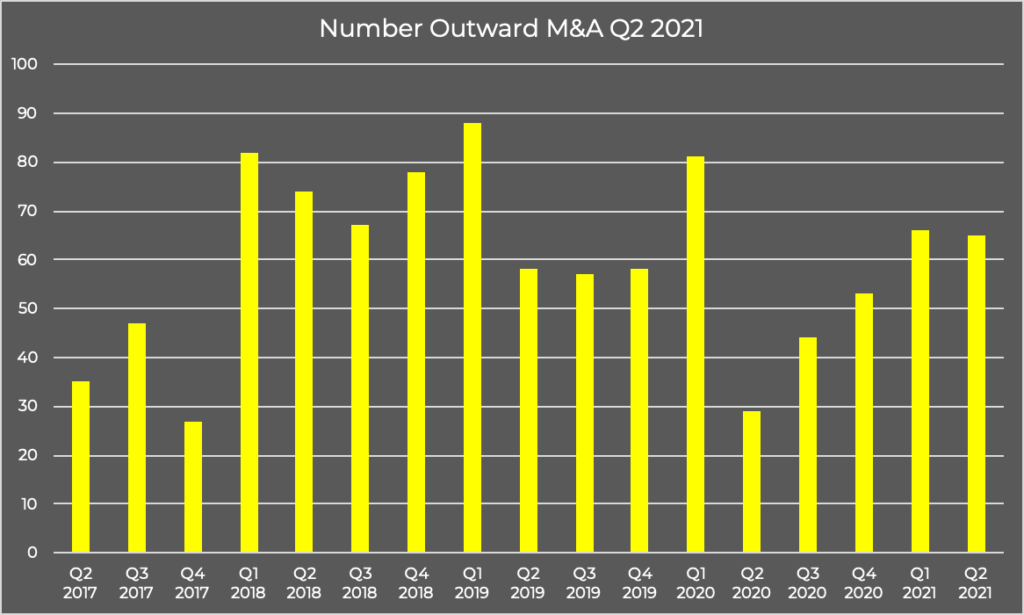

Number Outward M&A Q2 2021

There were 65 completed outward acquisitions in Q2 2021, a similar number as reported in Q1 (Jan-Mar) 2021 (66) yet 36 more transactions than Q2 2020 (29).

Notable outward acquisitions which completed in Q2 2021 were:

- Sensata Technologies Holding Plc acquired Xirgo Technologies Intermediate Holdings LLC of the USA, read press release

- Coca-Cola Europacific Partners Plc acquired Coca-Cola Amatil Ltd of Australia, read press release

The above data for M&A Statistics for Q2 2021 was extracted from the Office of National Statistics; full details here.

Want to know how the latest UK M&A statistics for Q2 2021 are relevant to your company sale? Then contact us now for a confidential appraisal of market appetite in your industry.

Tags: M&A Statistics, M&A Stats, Office for National Statistics, Q2 2021, UK