Latest UK M&A Statistics for Q3 2022

The UK Office for National Statistics have just released their latest statistics for Q3 2022 for Mergers and Acquisitions (M&A) involving UK companies.

Please note that these include only transactions that result in a change of ultimate control of the target company and have a value of £1M or more.

Statistics for Q3 2022 Headlines

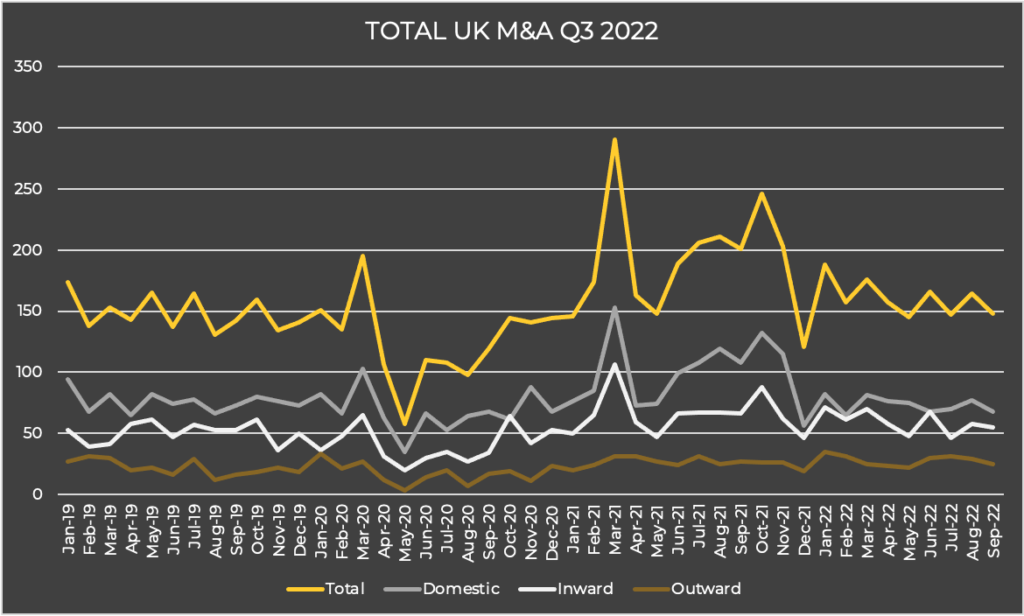

Total number of monthly domestic and cross-border M&A has been relatively consistent from January 2022 to September 2022, in-line with pre-pandemic levels.

Total combined number of monthly M&A increased between July 2022 (147) and August 2022 (164), before falling to 148 by the end of September 2022.

During Q3 2022 there were a total of 459 completed domestic and cross-border M&A, a decrease of nine compared with the previous quarter (468), and 159 fewer than Q3 2021 (618).

Total value of inward M&A in Q3 2022 was £25.0bn, £13.9bn higher than Q2 2022 (£11.1bn).

The value of outward M&A in Q3 2022 was £7.6bn, £2.8bn more than Q2 2022 (£4.8bn).

The value of domestic M&A was £2.6bn in Q3 2022, £0.7bn less than in the previous quarter (£3.3bn).

Monthly UK M&A Q3 2022

Monthly M&A activity has continued to be indirectly affected by Covid-19 and increased economic uncertainty arising from the Russian invasion of Ukraine.

During Q3 2022, the number of monthly inward M&A increased between July 2022 (46) and August 2022 (58) and was 55 during September 2022.

Monthly outward M&A saw a relatively consistent trend of activity, seeing 31 transactions in July and 29 during August, before declining to 25 in September 2022.

Domestic monthly M&A increased slightly between July (70) and August (77), before falling to 68 transactions during September 2022.

The Bank of England’s Agents’ summary of business conditions for Q3 2022 states “that merger and acquisition activity was reported to be slowing to more normal levels; and contacts said that companies were becoming more cautious about discretionary spending“. The same report also said that “a growing number of companies said that uncertainty about demand and the broader economic outlook and tighter financial positions had caused them to delay investment. High materials costs were also given as a factor in delaying investment plans. In addition, many companies said they had completed investment projects that had been delayed during the pandemic and were now returning to more normal levels of investment“.

Inward UK M&A Q2 2022

In Q3 2022 the total value of inward M&A rose to £25.0bn. This is an increase of £13.9bn compared with the previous quarter (£11.1bn), and double that of Q3 2021 (£12.5bn).

Two notable inward acquisitions in Q3 2022 were:

- Acquisition of Meggitt Plc of the UK by Parker Hannifin Corporation of the USA

- Acquisition of Ultra Electronics Holdings Plc of the UK by Advent International Corporation of the USA.

Value Inward UK M&A

The value of inward M&A between Q3 2018 and Q3 2022 ranged from £2.8bn to £38.8bn

Number Domestic UK M&A

There were 159 completed inward M&A deals in Q3 2022, a decrease of 15 on the previous quarter (174) and 41 fewer than in Q3 2021 (200).

During Q3 2022 there were 32 inward disposals worth £8.8bn, an increase on the previous quarter, when 24 transactions worth £4.7bn were reported.

Outward UK M&A Q3 2022

The value of outward M&A in Q3 2022 was £7.6bn. This was a £2.8bn increase compared with Q2 2022 (£4.8bn), although £24.5bn less than in Q3 2021 (£32.1bn).

Value Outward UK M&A

One notable outward transaction in Q 2022 was the acquisition of Affinivax Inc of the USA by GSK Plc of the UK.

Number Outward UK M&A

There were 85 outward M&A deals during Q3 2022, 10 more than Q2 2022 (75) and two more than Q3 2021 (83).

Q3 2022 saw 10 outward disposals valued at £0.9bn compared with 11 disposals valued at £3.4bn in Q2 2022.

Domestic UK M&A Q3 2022

In Q3 2022 the value of domestic M&A was £2.6bn. This was £0.7bn lower than Q2 2022 (£3.3bn) and £0.5bn lower than Q3 2021 (£3.1bn).

A large-value domestic acquisition which completed in Q3 2022 was the acquisition of Gist Limited of the UK by Marks and Spencer Plc of the UK.

Value Domestic UK M&A

The value of domestic M&A between Q3 2018 and Q3 2022 ranged from £0.9bn to £17.9bn.

Number Domestic UK M&A

There were 215 domestic acquisitions in Q3 2022, 4 fewer than Q2 2022 (219) and 120 less than Q3 2021 (335).

The number of domestic M&A between Q3 2018 and Q3 2022 ranged from 164 to 335 transactions.

The above data for M&A Statistics for Q3 2022 was extracted from the Office of National Statistics; full details here.

Want to know how the latest UK M&A statistics for Q3 2022 are relevant to your company sale? Then contact us now for a confidential appraisal of market appetite in your industry.

Tags: M&A Statistics, M&A Stats, Office for National Statistics, Q3 2022, UK