Latest UK M&A Statistics for Q1-25

The UK Office for National Statistics have just released their latest statistics for Q1-25. Below is the update on Mergers and Acquisitions (M&A) involving UK companies for Q1 2025, during the period January to March 2025.

Please note that these include only transactions that result in a change of ultimate control of the target company and have a value of £1M+. Also numbers are provisional and may be subject to revisions in either direction, but are more likely to be upwards than downwards.

Headline Statistics for UK M&A Q1-25

In Q1-25, total number of mergers and acquisitions (M&A) were at an all-time high since end 2022, driven by some large deals, rather than an increased number of deals:

- Total M&A was 395, 102 fewer transactions than in the previous quarter (497)

- Monthly M&A saw a total of 148 in JAN-25, falling 45 to 103 in FEB-25, then increasing by 41 to 144 in MAR-25

- Value inward M&A Q1-25 increased significantly to £19.2Bn, ranging from £4.0Bn to £32.9Bn over the period.

- Value outward M&A in Q1-25 was £9.4Bn, £7.6Bn higher than the previous quarter (£1.8Bn)

- Domestic M&A in Q1-2025 was £2.9Bn, an decrease of £3.5Bn than for the previous quarter (£6.4Bn)

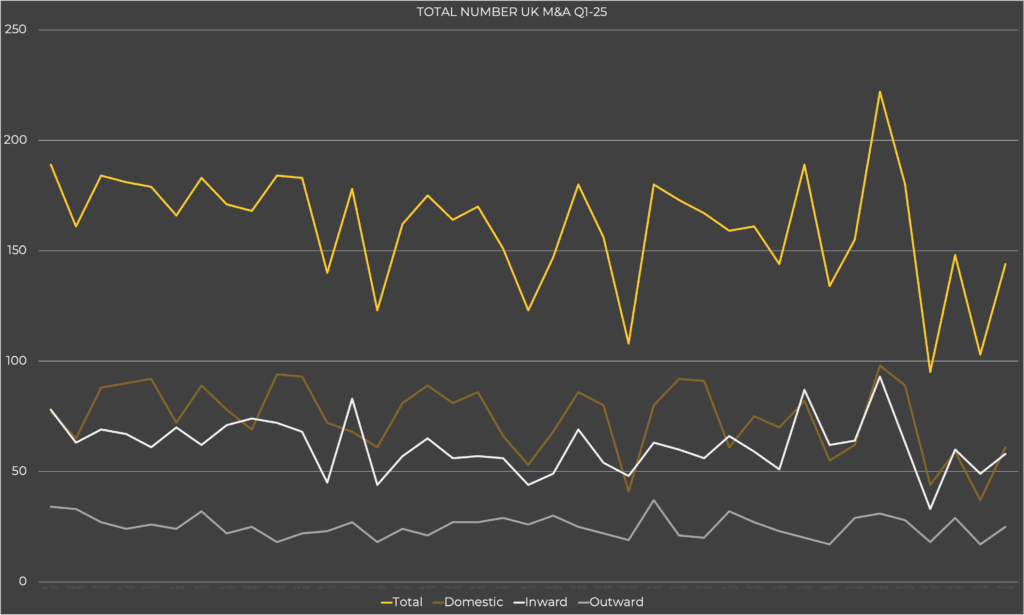

Monthly UK M&A Q1-25

Total M&A saw a notable decrease between JAN-25 (148) and FEB-25 (103) then rising in MAR-25 (144).

Total number of monthly UK M&A from JAN-22 to MAR-25 ranged from 95 to 222.

Domestic monthly UK M&A was 60 transactions JAN-25, decreasing to 37 FEB-25 then increasing to 61 MAR-25.

Outward monthly UK M&A saw a fall between JAN-25 (29) and FEB-25 (17) before rising again in MAR-25 (25).

Inward monthly UK M&A was 60 acquisitions JAN-25, 49 FEB-25 and 58 MAR-25.

The Bank of England summary of business conditions for Q1-25 reported that:

Increasing financial pressures in firms, partly associated with the upcoming labour market policy changes and a weak demand outlook, are deterring investment. Some businesses are waiting to see how current conditions evolve before committing to spend and some are already cutting back on plans. For others, availability of credit in their sectors and costs continue to constrain investment, especially those who are cash-poor.

Later in the report stated:

Mergers and acquisitions activity shows some signs of improvement, but growth is constrained by caution among buyers and sellers. Restructuring and insolvency activity remains slightly higher on a year ago.

Inward UK M&A Q1-25

Value Inward UK M&A Q1-25

Value inward M&A in Q1-25 increased significantly to £19.2Bn, £15.2Bn higher than previous quarter (4.0Bn) and £12.8Bn more than Q1-24 (£19.2Bn), the highest value since Q3-22 (22.4Bn).

Notable inward M&A transactions completing in Q1-25 were:

- DS Smith PLC of UK acquired by International Paper Company of US

- Britvic PLC of UK acquired by Carlsberg A/S of Denmark

- AGS Airports Holding Ltd of UK acquired by Public Sector Pension Investments Board of Canada

Value of inward UK M&A between Q1-21 and Q1-25 ranged from £4.0Bn to £32.9Bn.

Number Inward UK M&A Q1-25

Inward UK M&A transactions in Q1-25 were 167, 22 fewer than previous quarter (189) & 12 fewer than Q1-24 (179).

Total number of inward M&A acquisitions between Q1-21 and Q1-25 ranged from 149 to 221, decreasing between Q3-24 and Q1-25.

Outward UK M&A Q1-25

Value of outward UK M&A Q1-25

Value of outward M&A in Q1-25 was £9.4Bn, the highest since Q4-22 (10.1Bn). This was £7.6Bn higher than in the previous quarter (£1.8Bn) and £4.7Bn higher than Q1-24 (£4.7Bn).

One large valued outward acquisition, which completed in Q1-25 was:

Value outward UK M&A rose sharply to £9.4Bn in Q1-25, ranging from £1.8Bn to £32.1Bn between Q1-21 and Q1-25.

Number Outward UK M&A Q1-25

There were 71 outward acquisitions in Q1-25, 6 fewer than in the previous quarter (77) and 7 less than Q1-24 (78).

Total number of outward UK M&A between Q1-21 and Q1-25 ranged from 63 to 94 transactions.

Domestic UK M&A Q1-25

Value Domestic UK M&A Q1-25

Value of domestic M&A in Q1-25 was £2.9Bn, an decrease of £3.5Bn from previous quarter (£6.4Bn) and £0.3Bn less than Q1-24 (£3.2Bn).

A notable domestic acquisition, which completed in Q1-25 was:

Value of domestic M&A between Q1-21 and Q1-25 ranged from £2.1Bn to £17.9Bn.

Number Domestic UK M&A Q1-25

Domestic M&A was 157 during Q1-25, 74 fewer than previous quarter (231) & 106 fewer than Q1-25.

Total number of domestic M&A between Q1-21 and Q1-25 ranged from 157 to 335, falling to 157 transactions.

The above data for M&A Stats Q1-25 was extracted from the Office of National Statistics; full details here.

Do you want to know how the latest UK M&A statistics for Q4-24 are relevant to your company sale? Then contact us now for a confidential appraisal of potential market appetite for your industry.

Tags: 2025, M&A Statistics, M&A Stats, Office for National Statistics, Q1, Q1-25, UK