Latest UK M&A Statistics for Q3 2023

The UK Office for National Statistics have just released their latest statistics for Q3 2023. Below is the update on Mergers and Acquisitions (M&A) involving UK companies for Q3 2023, during the period July to September 2023.

Please note that these include only transactions that result in a change of ultimate control of the target company and have a value of £1M or more.

Headline Statistics for UK M&A Q3 2023

Provisional estimates for Q3 2023 indicate a general slowdown in activity, although outward M&A (UK companies acquiring foreign companies) was marginally up on the last quarter.

Total M&A was 362 in Q3 2023; 117 transactions fewer than in Q2 2023 (479).

Value of domestic M&A in Q3 2023 was £2.6Bn; £0.2Bn lower than in the previous quarter (£2.8Bn).

Total value of outward M&A in Q3 2023 was £2.2Bn; £0.2Bn higher than in Q2 2023 (£2.0Bn).

*N.B. These numbers are provisional and may be subject to upward revisions until Q3 2024.

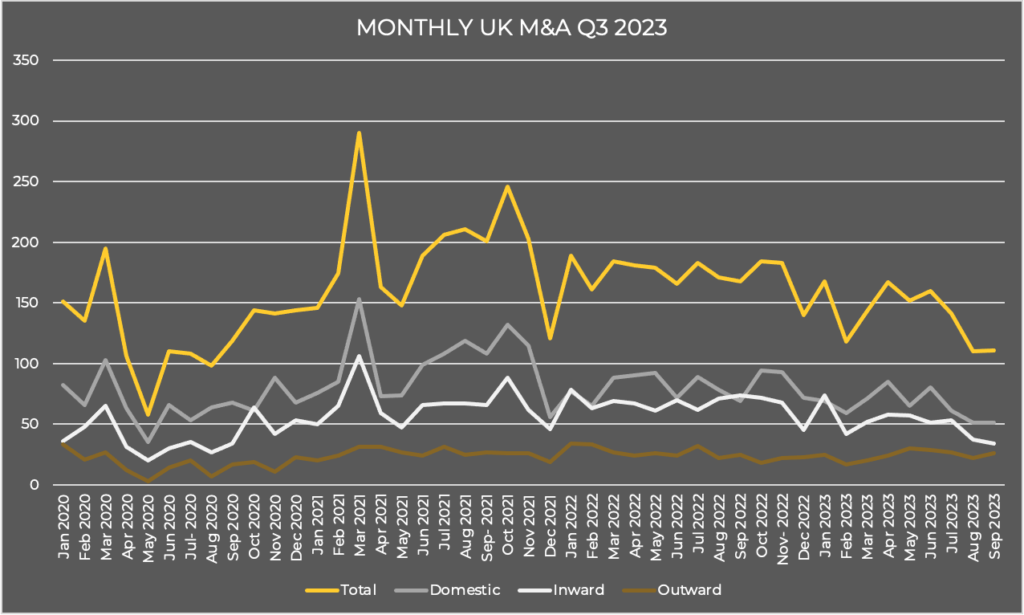

Monthly UK M&A Q3 2023

M&A activity dropped substantially at the start of the global pandemic in 2020 but strengthened during 2021 and has remained relatively consistent during 2022. Provisional estimates indicate some weakening during the second and third quarters of 2023, although these estimates are subject to revision, the direction of which is more likely to be upward than downward.

The provisional total numbers of monthly domestic and cross-border M&A fell during July 2023 (141), falling further during August (110) before stabilising in September (111) 2023.

Total number of monthly deals involving UK companies from January 2020 to September 2023 ranged from 58 to 290.

Monthly inward M&A saw 53 acquisitions during July before falling to 37 in August, with a further fall to 34 in September 2023.

Monthly outward M&A saw relatively stable numbers, with 27 acquisitions during July, 22 in August and 26 during September 2023.

The number of domestic monthly M&A in July was 61, before falling to 51 in both August and September 2023.

The Bank of England’s summary of business conditions for Q3 23 (JUL-SEP) reported that

“investment intentions remained subdued in general, although they varied across contacts. Many contacts reported that pressure on cash flow and margins was increasingly deterring them from investment. Contacts in the business services sector said they were largely planning normal levels of investment, although some were making cuts to protect profitability”. This same report stated that “credit demand remained weak across all sizes of business, reflecting the higher cost of borrowing and a more negative economic outlook. Businesses were generally reluctant to take out new loans”.

The Bank of England

Inward UK M&A Q3 2023

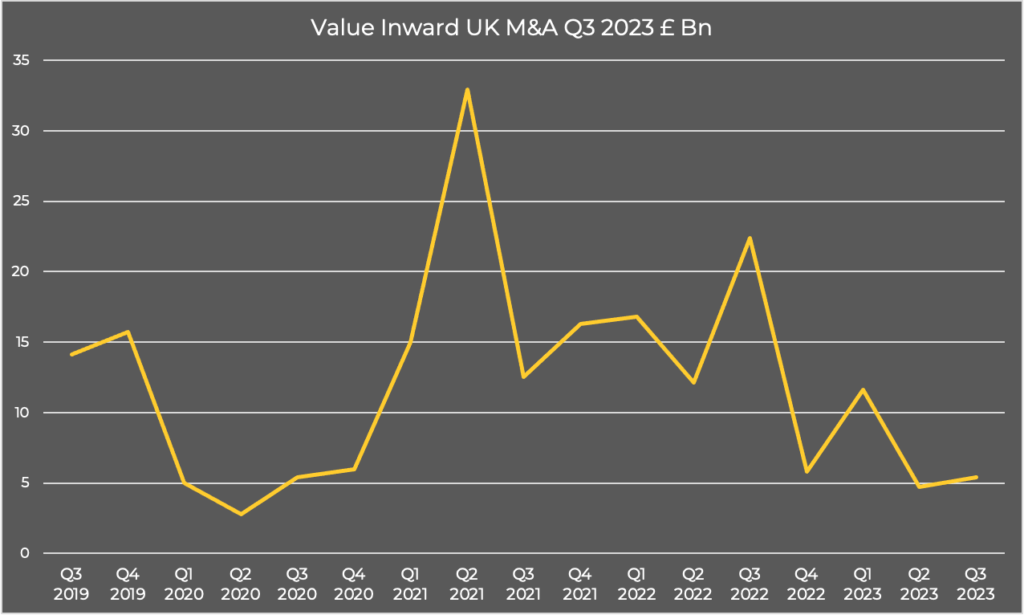

Value Inward UK M&A Q3 2023

The provisional estimated value of inward M&A in Q2 2023 rose to £5.4Bn. This was an increase of £0.7Bn compared with the previous quarter (£4.7Bn) and a sizeable £17.0Bn lower than for the same period the previous year (£22.4 billion).

The value of inward M&A between Q3-19 and Q3-23 ranged from £2.8Bn to £32.9Bn.

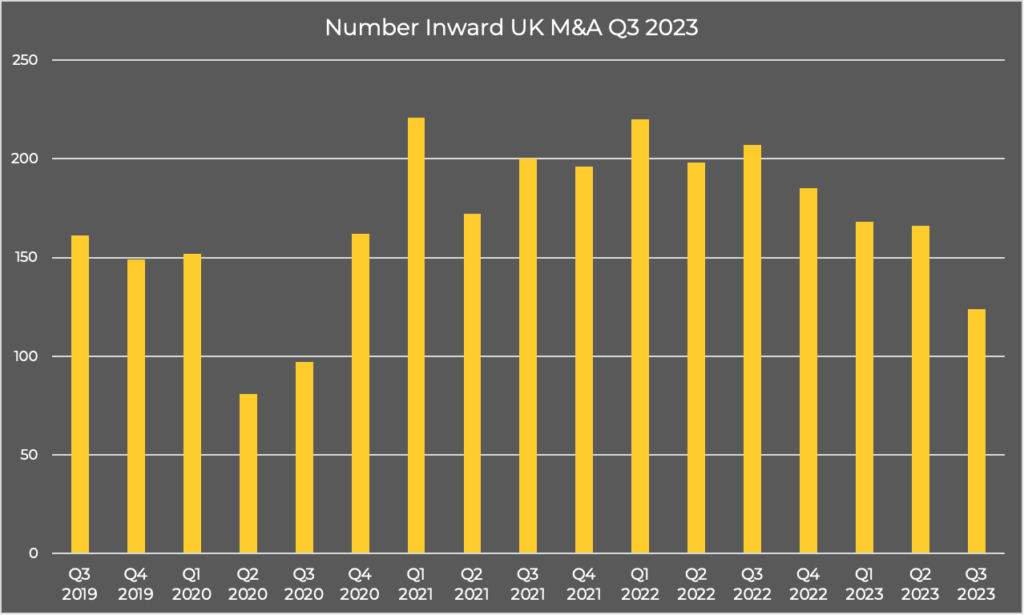

Number Inward UK M&A Q3 2023

In Q3 2023, there were 124 completed inward M&A transactions. This was a decrease of 42 on the previous quarter (166) and 83 fewer than in the same period 2022 (207).

The total number of inward M&A between Q3-19 and Q3-23 ranged from 81 to 221.

Outward UK M&A Q3 2023

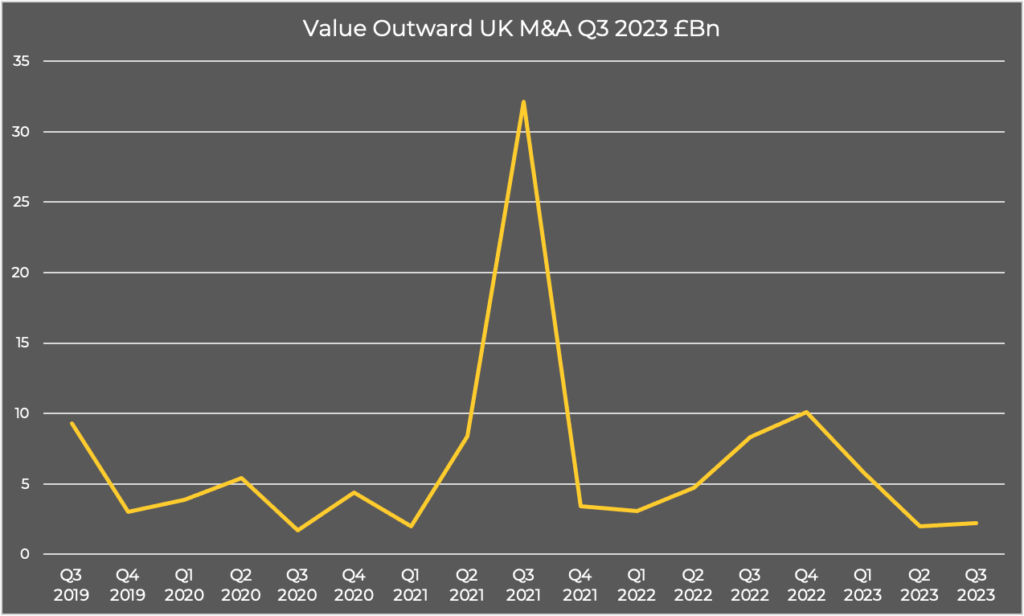

Value Outward UK M&A Q3 2023

In Q3 2023 the value of outward M&A was £2.2Bn, £0.2Bn more than in the previous quarter (£2.0Bn) and £6.1Bn lower than in the same period 2022 (£8.3Bn).

A notable outward acquisition that completed in Q3 2023 was by Croda International Plc of the UK which acquired Solus Biotech Co Ltd of South Korea.

Value of outward M&A between Q3 2019 & Q3 2023 ranged from £1.7Bn to £32.1Bn.

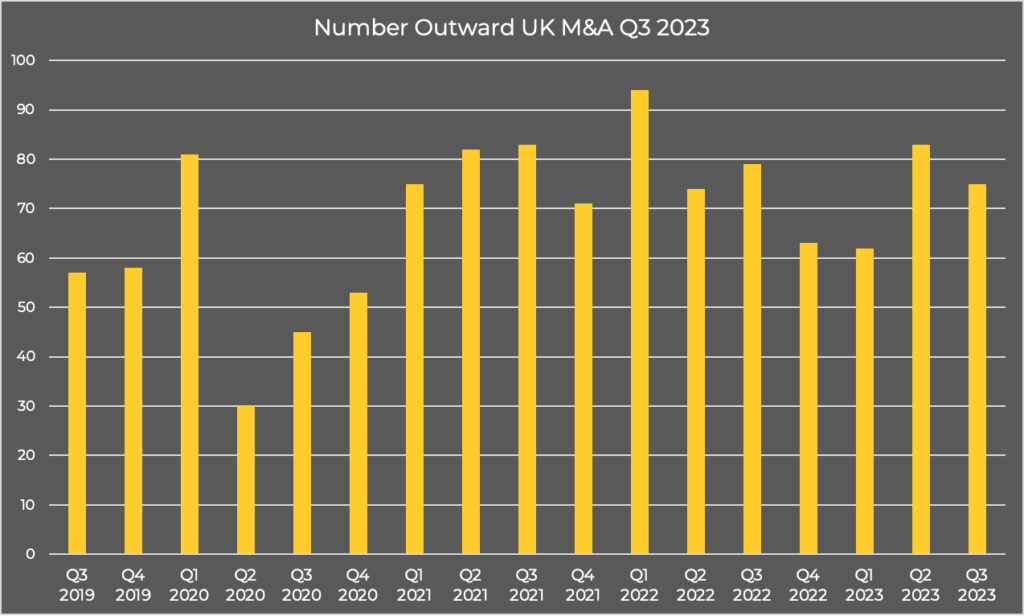

Number Outward UK M&A Q3 2023

There were 75 outward acquisitions in Q3 2023, 8 fewer than in the previous quarter (83) and 4 fewer than Q3 2022 (79).

Total number of outward M&A between Q3 2019 & Q3 2023 ranged from 30 to 94 transactions.

Domestic UK M&A Q3 2023

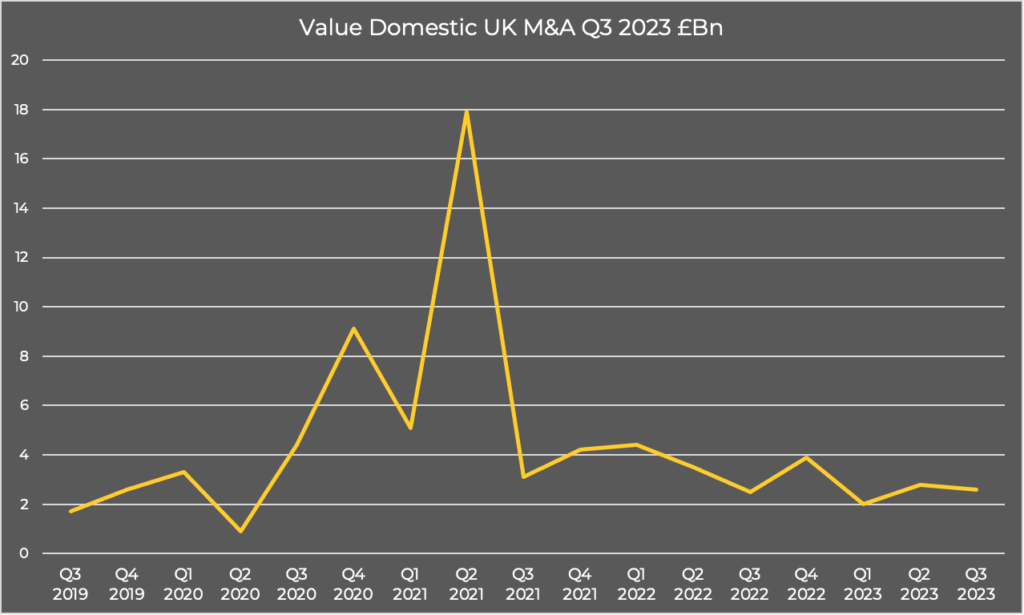

Value Domestic UK M&A Q3 2023

Value of domestic M&A in Q3 2023 was £2.6Bn, a £0.2Bn decrease compared with Q2 2023 (£2.8Bn) and £0.1Bn more than in the same period 2022 (£2.5Bn).

One notable domestic deal in Q3 2023 was Greencoat UK Wind Plc of the UK which acquired South Kyle Wind Farm Ltd of the UK.

Value of domestic M&A between Q3 2019 & Q3 2023 ranged from £0.9Bn to £17.9Bn.

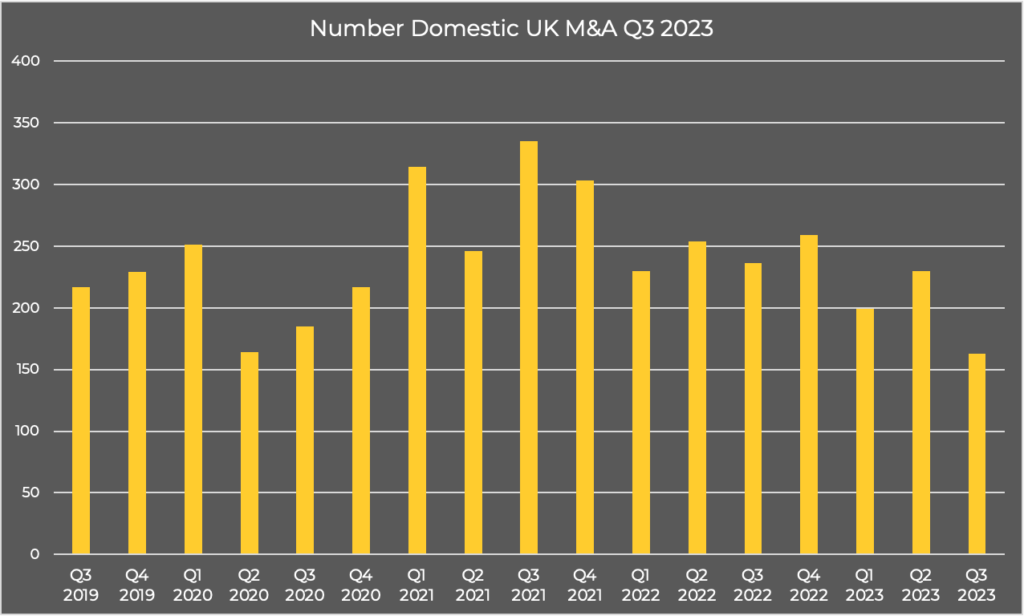

Number Domestic UK M&A Q3 2023

There were 163 domestic M&A deals during Q3 2023, 67 fewer than in the previous quarter, when 230 were recorded, and 73 fewer than in the same period 2022 (236).

The total number of domestic M&A between Q3 2019 & Q3 2023 ranged from 163 to 335.

The above data for M&A Statistics for Q3 2023 was extracted from the Office of National Statistics; full details here.

Do you want to know how the latest UK M&A statistics for Q3 2023 are relevant to your company sale? Then contact us now for a confidential appraisal of potential market appetite for your company sale.

Tags: M&A Statistics, M&A Stats, Office for National Statistics, Q3 2023, UK