Latest UK M&A Stats for Q2-25

The UK Office for National Statistics have just released their latest statistics for Q2-25. Below is the update on Mergers and Acquisitions (M&A) involving UK companies for Q2 2025, during the period April to June 2025.

Please note that these include only transactions that result in a change of ultimate control of the target company and have a value of £1M or more. Also numbers are provisional and may be subject to revisions in either direction, but are more likely to be upwards than downwards.

Headline Statistics for UK M&A Q2-25

In Q1-25, total number of mergers and acquisitions (M&A) increased in Q2 2025, due to higher number of deals in April.

- Total M&A for Q2-25 was 501, 102 89 more than in the previous quarter (412)

- Monthly M&A for Q2-25 saw a total of 216 in APR-25, falling to 138 in MAY-25, then increasing to 147 in JUN-25

- Domestic M&A in Q2-25 was £3.4Bn, an increase of £0.6Bn than for the previous quarter (£2.8Bn).

- Value outward M&A in Q2-25 was £4.0Bn, £4.0Bn lower than the previous quarter (£8.0Bn).

- Value inward M&A Q2-25 decreased significantly to £9.3Bn, £11.8Bn lower than for the previous quarter (£21.1Bn).

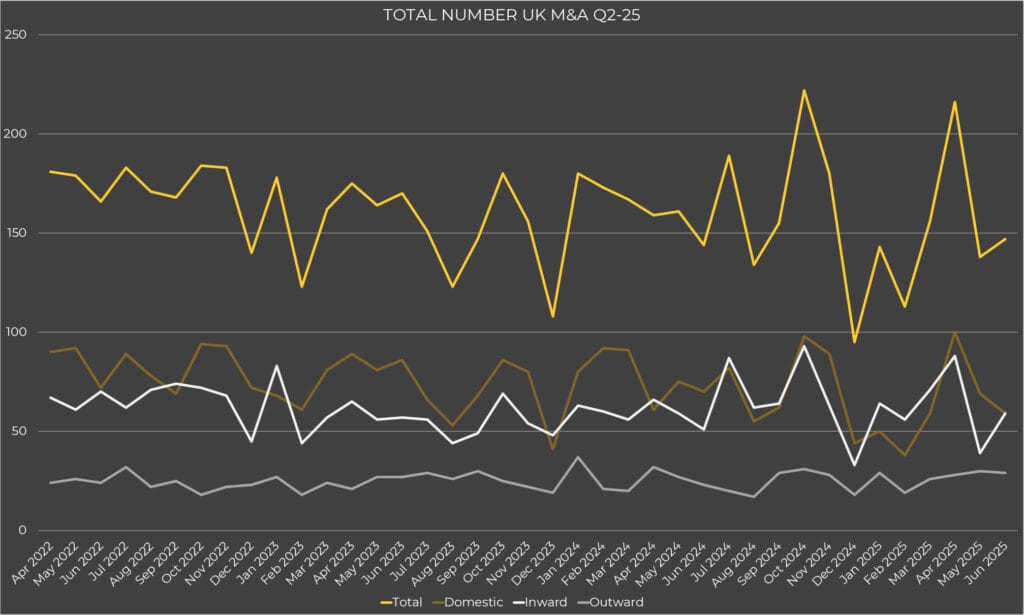

Monthly UK M&A Q2-25

Total M&A for Q2-25 was relatively high compared to previous years was with 216 in APR-25 but falling in MAY-25 (138) and then rising in JUN-25 (147).

Total number of monthly UK M&A from APR-22 to JUN-25 ranged from 95 to 222.

Domestic monthly UK M&A was 100 transactions APR-25, decreasing to 69 MAY-25 then increasing to 59 JUN-25.

Outward monthly UK M&A was broadly consistent over Q2-25 as APR-25 (28) and MAY-25 (30) & JUN-25 (29).

Inward monthly UK M&A was 88 acquisitions APR-25, falling to 39 MAY-25 and increasing 59 JUN-25.

The Bank of England summary of business conditions for Q2-25 reported that:

“Investment intentions seem subdued but broadly stable and not quite at the lows seen in previous months. There are fewer references to significant cuts in the year ahead. Several uncertainties are weighing on the confidence needed to commit to future investment plans, raising the bar for return on investment and leading to increased scrutiny of capital expenditure plans. Contacts cite fragile demand, trade developments, government tax, and Labour policies squeezed profitability and costs of capital goods as factors”.

This same report stated:

“Business services contacts report that their clients are managing budgets more closely and delaying spending decisions because of cost pressures and greater uncertainty. Merger and acquisition activity is more subdued owing to higher uncertainty”.

Domestic UK M&A Q2-25

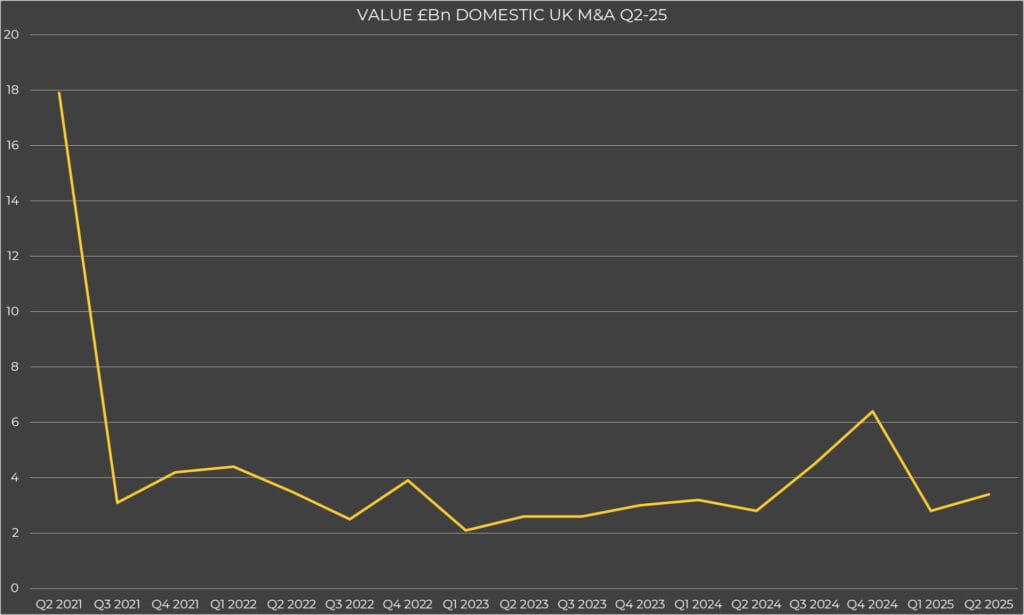

Value Domestic UK M&A Q2-25

Value of domestic M&A in Q2-25 was £3.4Bn, a marginal increase of £0.6Bn from previous quarter (£2.8Bn) and Q2-24 (also £2.8Bn).

A notable domestic acquisition which completed in Q2-25 was:

- Urban Logistics Reit PLC of the UK, which was acquired by London Metric Property PLC, also of the UK

Value of domestic M&A between Q2-21 and Q2-25 ranged from £2.1Bn to £17.9Bn.

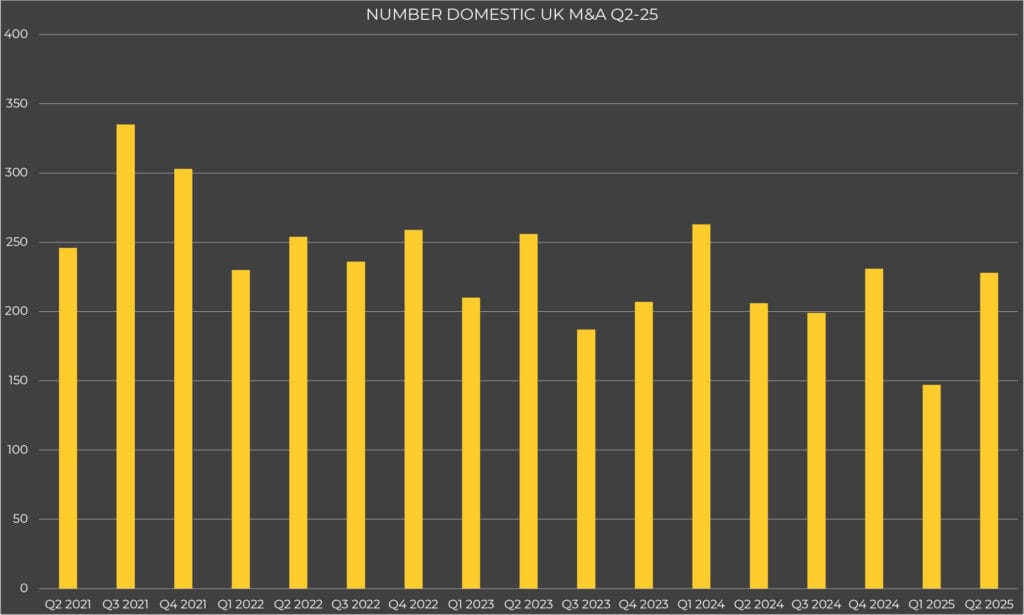

Number Domestic UK M&A Q2-25

Domestic M&A was 228 during Q2-25, 81 more than previous quarter (1477) & 22 more than Q2-24 (206).

Total number of domestic M&A between Q2-21 and Q2-25 ranged from 147 to 335.

Outward UK M&A Q2-25

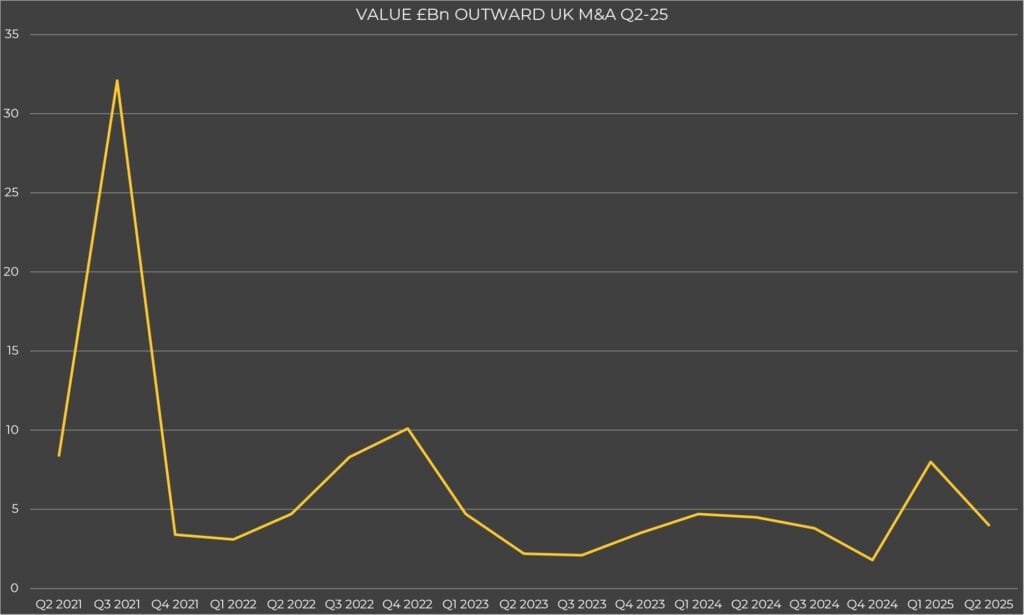

Value £Bn Outward UK M&A Q2-25

Value of outward M&A in Q2-25 was £4.0Bn, £4.0Bn lower than Q1-25 (£8.0Bn) and £0.5Bn less than Q2-24 (£4.5Bn).

Two large valued outward acquisition, which completed in Q2-25 was:

- DAZN Group UK Ltd of the UK, which acquired Foxtel Group of Australia

- AstraZeneca PLC of the UK, which acquired EsoBiotec SA of Belgium

Value outward UK M&A between Q2-21 and Q2-25 ranged from £1.8Bn to £32.1Bn.

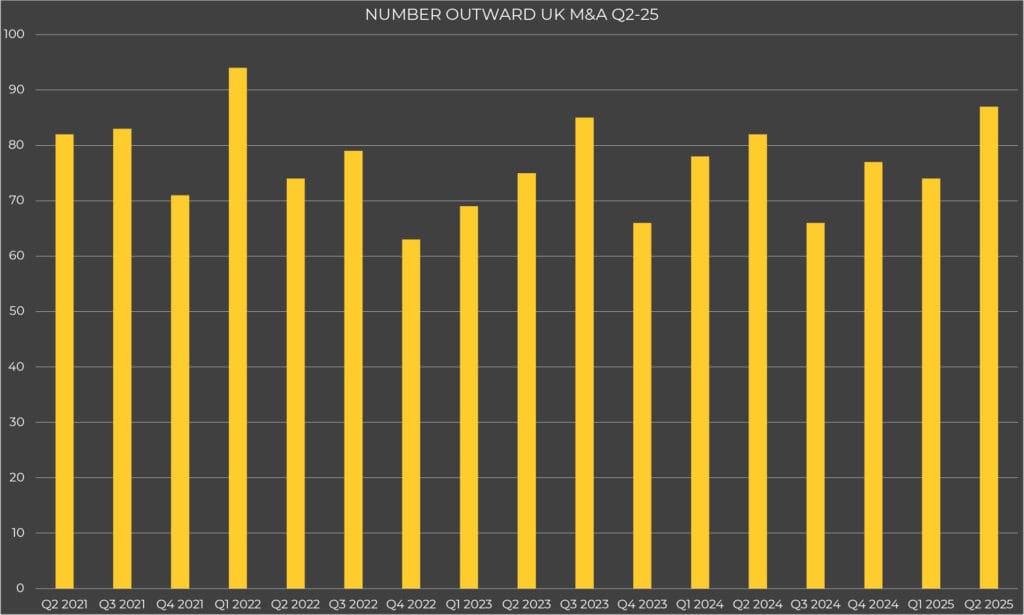

Number Outward UK M&A Q2-25

There were 87 outward acquisitions in Q2-25, 13 more than in the previous quarter (74) and 5 more than Q2-24 (82).

Total number of outward UK M&A between Q2-21 and Q2-25 ranged from 63 to 94 transactions.

Inward UK M&A Q2-25

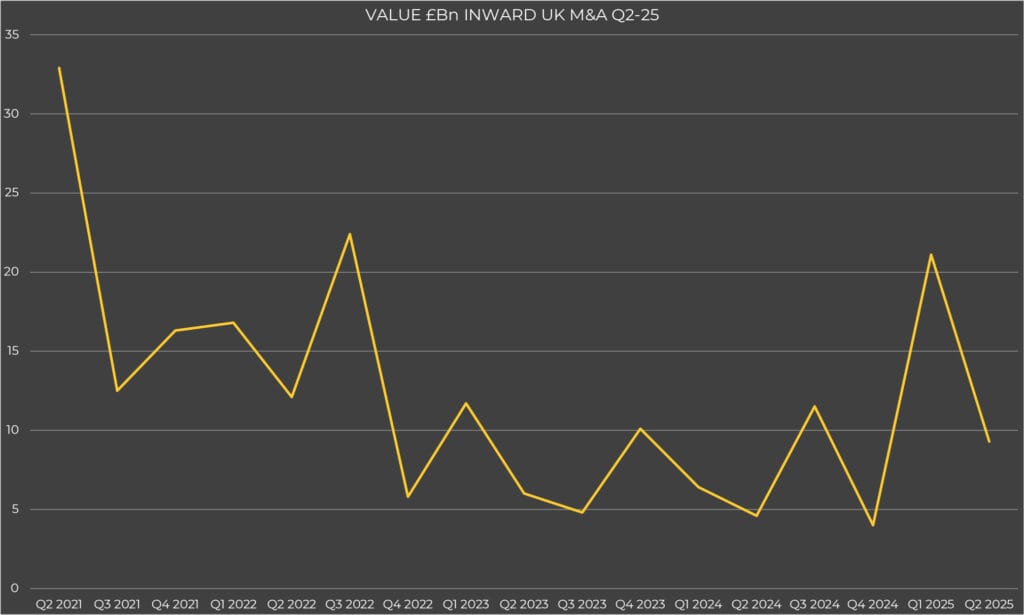

Value Inward UK M&A Q2-25

Value inward M&A in Q2-25 fell to £9.3Bn, £11.8Bn lower than previous quarter (21.1Bn) but £4.7Bn more than Q2-24 (£4.6Bn).

Notable inward M&A transactions completing in Q2-25 were:

- International Distribution Services PLC of the UK, which was acquired by EP Investment Sarl of Luxembourg

- TI Fluid Systems PLC of the UK, which was acquired by Apollo Global Management of Canada

Value of inward UK M&A fell to £9.3Bn in Q2-225

Value of inward UK M&A between Q2-21 and Q2-25 ranged from £4.0Bn to £32.9Bn.

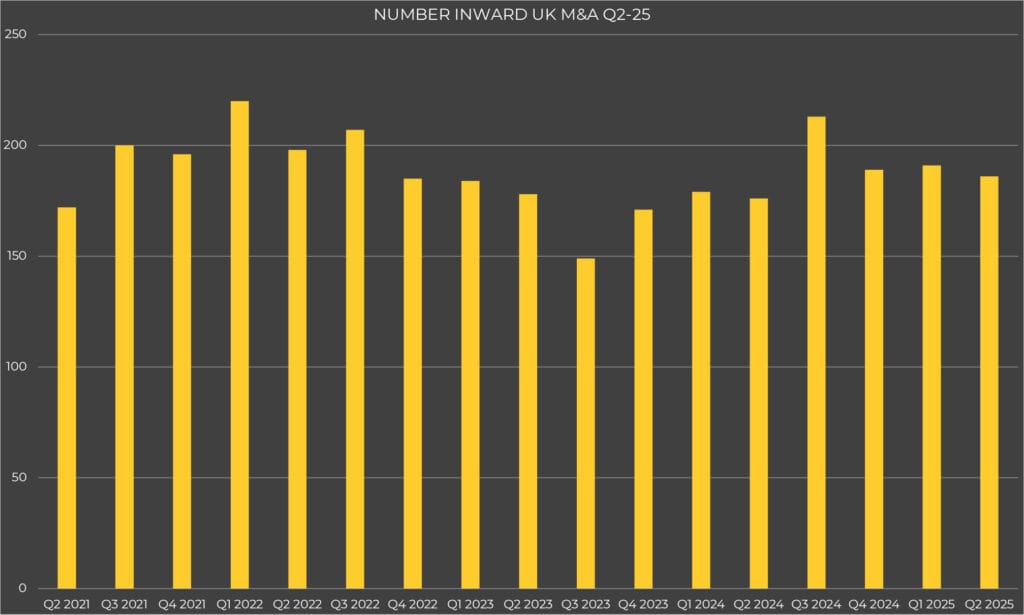

Number Inward UK M&A Q2-25

Inward UK M&A transactions in Q2-25 were 186, 5 fewer than previous quarter (191) & 10 more than Q2-24 (176).

Total number of inward M&A acquisitions between Q2-21 and Q2-25 ranged from 149 to 220, remaining largely stable from Q4-24 to Q2-25.

The above data for M&A Stats Q2-25 was extracted from the Office of National Statistics; full details here.

Want an understanding of how the latest UK M&A statistics for Q2-25 are relevant to your company sale? Then contact us now for a confidential appraisal of potential market appetite for your industry.

Tags: M&A Statistics, M&A Stats, Office for National Statistics, Q2 2025, Q2-25, UK