Latest UK M&A Stats for Q3-25

The UK Office for National Statistics have just released their latest statistics for Q3-25. Below is the update on Mergers and Acquisitions (M&A) involving UK companies for Q3 2025, during the period July to September 2025.

Please note that these include only transactions that result in a change of ultimate control of the target company and have a value of £1M or more. Also numbers are provisional and may be subject to revisions in either direction, but are more likely to be upwards than downwards.

Headline Statistics for UK M&A Q3-25

Total value of completed M&A remains broadly unchanged in Q3-25, but the number of completed domestic M&A decreased to its lowest level since 2017.

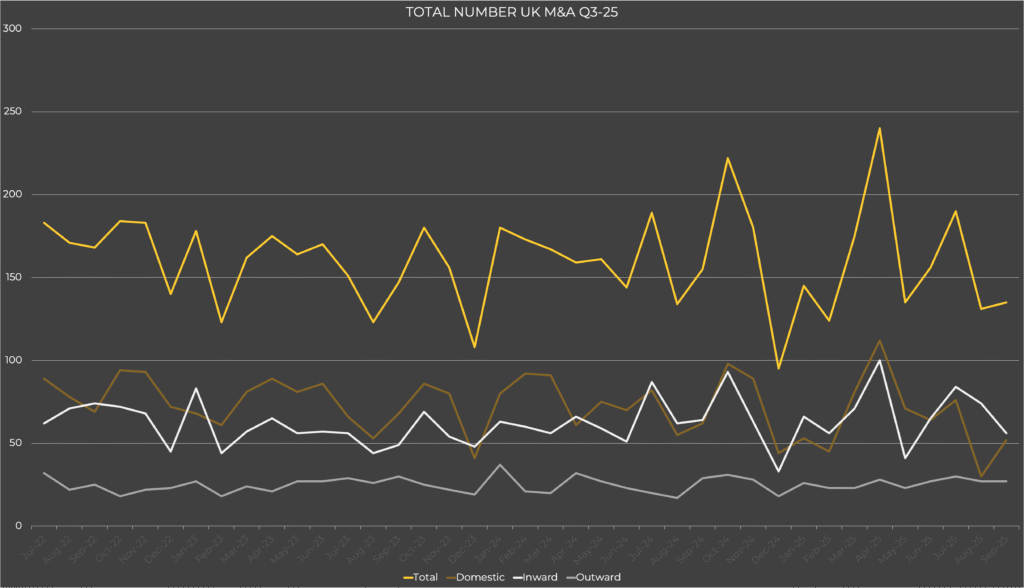

- Total number of M&A was 456 during Q3-25, a fall of 75 from Q2-25 (531).

- JUL-25 saw 190 acquisitions AUG-25 figures fell to 131, then increased to 135 in SEP-25.

- Value of domestic M&A in Q3-25 was £5.3Bn, £1.9Bn higher than in Q2-25 (£3.4Bn), despite the low number of deals.

- Value of outward M&A was £3.4Bn in Q3-25, £0.2 billion higher than in the previous quarter (£3.2Bn).

- Inward M&A in Q3-25 was £7.9Bn, £1.8Bn less than the value in Q2-25 (£9.7Bn).

Figure shows numbers Monthly UK M&A Q3-25 have ranged from 95 to 240 from JUL-22 to SEP-25.

- Domestic monthly M&A was 76 transactions JUL-25, decreasing to 30 in AUG-25 then increasing to 52 in SEP-25.

- Outward monthly M&A was broadly consistent over JUL-25 (30), AUG-25 (27) and SEP-25 (27).

- Inward monthly M&A was 84 acquisitions JUL-25, falling to 74 AUG-25 and 56 SEP-25.

The Bank of England’s Agent’s latest summary of business conditions Q3-25 reported that:

Uncertainty, subdued demand, and financial constraints remain the main limiting factors on investment intentions. Fewer contacts than in the last round mentioned UK labour cost pressures from the changes to National Living Wage (NLW) and employer contributions to National Insurance (NICs), suggesting the impact is settling. Mentions of international trade uncertainty also declined. Despite this, some multinationals still prioritize non-UK investment, citing fiscal policy uncertainty, energy costs, planning delays, and labour costs as deterrents to UK-based investment.

This same report stated that:

Mergers and acquisitions and other high-value transactions remain weak.

Domestic UK M&A Q3-25

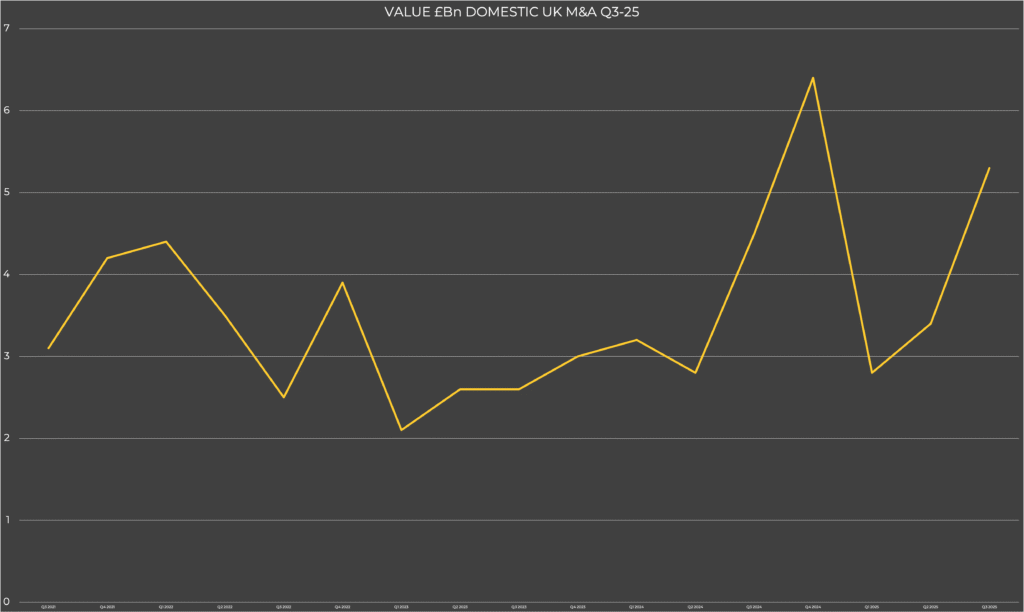

Value Domestic UK M&A Q3-25

Value of domestic M&A in Q3-25 was £5.3Bn, a notable increase of £1.9Bn when compared with both Q2-25 (£3.4Bn) and Q3-24 (£4.5Bn).

At least one notable domestic M&A transaction that completed in Q3-25 was:

Value of domestic M&A between Q3-21 and Q3-25 ranged from £2.1Bn to £6.4Bn

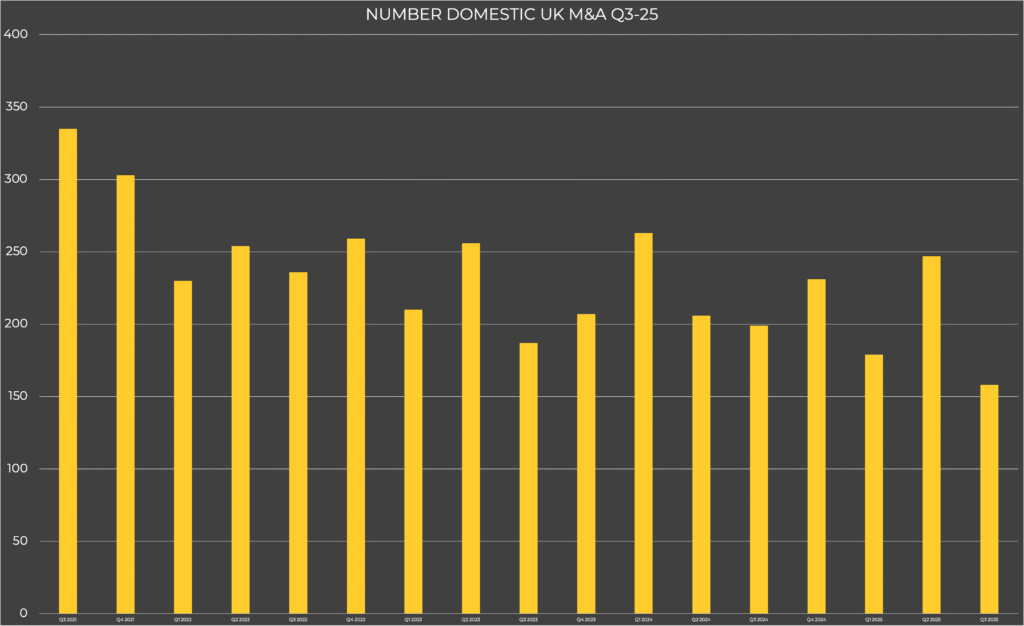

Number Domestic UK M&A Q3-25

Domestic M&A was 158 during Q3-25, 89 fewer than previous quarter (247) & 41 fewer than Q3-24 (199). This was the lowest number of transactions since Q4-17 despite the high value of domestic M&A.

Total number of domestic M&A between Q3-21 and Q3-25 ranged from 158 to 335.

Outward UK M&A Q3-25

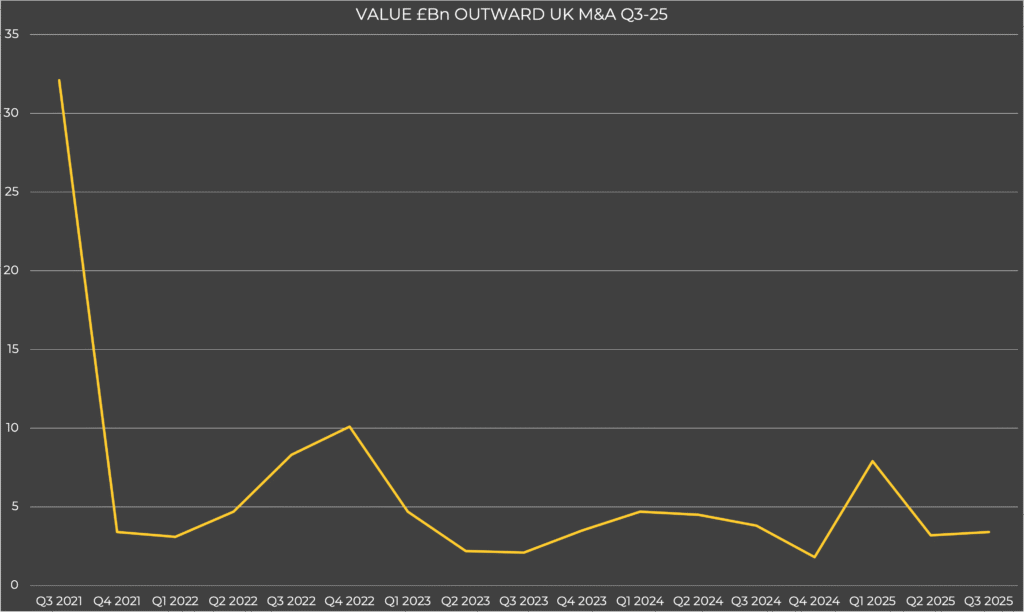

Value £Bn Outward UK M&A Q3-25

Value of outward M&A in Q3-25 was £3.4Bn, £0.2Bn higher than Q2-25 (£3.2Bn) but £0.4Bn less than Q3-24 (£3.8Bn).

A large valued outward acquisition, which completed in Q3-25 was:

Value outward UK M&A between Q3-21 and Q3-25 ranged from £1.8Bn to £32.1Bn.

Number Outward UK M&A Q3-25

There were 84 outward acquisitions in Q3-25, 6 more than in the previous quarter (78) and 18 more than Q3-24 (66).

Total number of outward UK M&A between Q3-21 and Q3-25 ranged from 63 to 94 transactions.

Inward UK M&A Q3-25

Value Inward UK M&A Q3-25

Value inward M&A in Q3-25 was £7.9Bn, £1.8Bn lower than previous quarter (9.7Bn) and £3.6Bn lower than Q3-24 (£11.5Bn).

A notable inward M&A transactions completing in Q3-25 was:

Value of inward UK M&A fell to £7.9Bn in Q3-225

Value of inward UK M&A between Q3-21 and Q3-25 ranged from £4.0Bn to £22.4Bn.

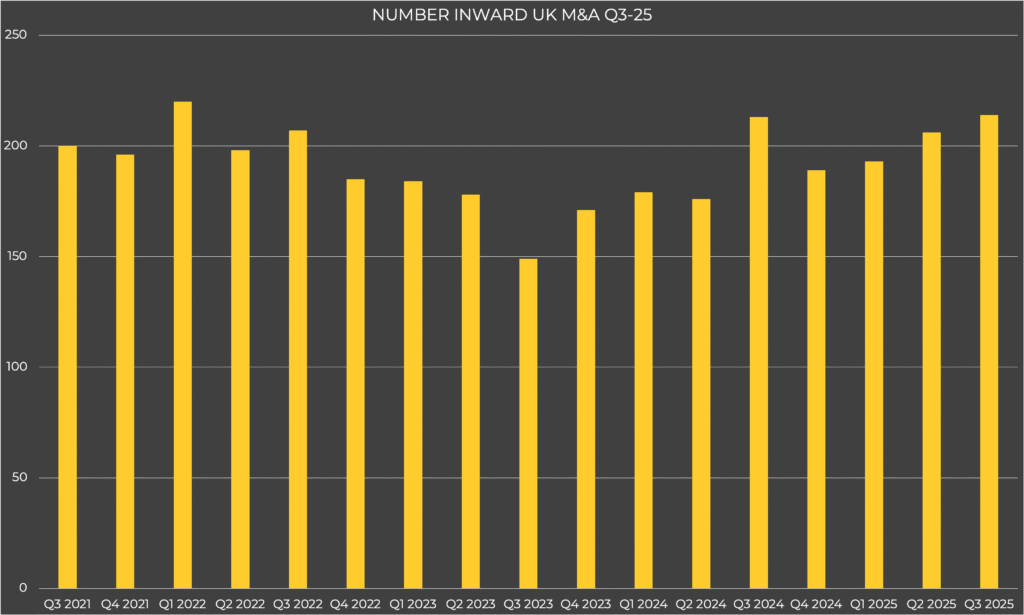

Number Inward UK M&A Q3-25

Inward UK M&A transactions in Q3-25 were 214, 8 more than previous quarter (206) & 1 more than Q3-24 (213).

Total number of inward M&A acquisitions between Q3-21 and Q3-25 ranged from 149 to 220.

The above data for M&A Stats Q3-25 was extracted from the Office of National Statistics; full details here.

There have been significant tax changes in November, especially for those business owners thinking about an exit via an EOT (Employee Ownership Trust). Get informed if you’d be interested to know how these and the latest UK M&A statistics for Q3-25 are relevant to your company sale.

If you are a business owner considering an exit and have EBITDA north of £1M we would be happy to give you a confidential appraisal, contact us here.

Tags: M&A Statistics, M&A Stats, Office for National Statistics, Q3 2025, Q3-25