support to private company owners

wanting the best possible exit

Specialist advisory support for private business owners aimed at creating maximum value for an eventual exit, Ongoing bespoke programme and support helps shape and execute growth and exit strategies.

In-depth action plan using CF data analysis providing a comprehensive ‘go-to-market’ strategy. Benchmarking against main competitors, valuation guide, exit options, identifies typical buyers.

A comprehensive company sale service from initial instruction through to completed sale. High-level corporate finance support, strong research facility combined with exceptionally experienced sales ability at CEO level.

In this video, Justin Levine, MD of TheNonExec Limited, and Nick Davies, Partner and M&A Solicitor at Steele Raymond LLP,...

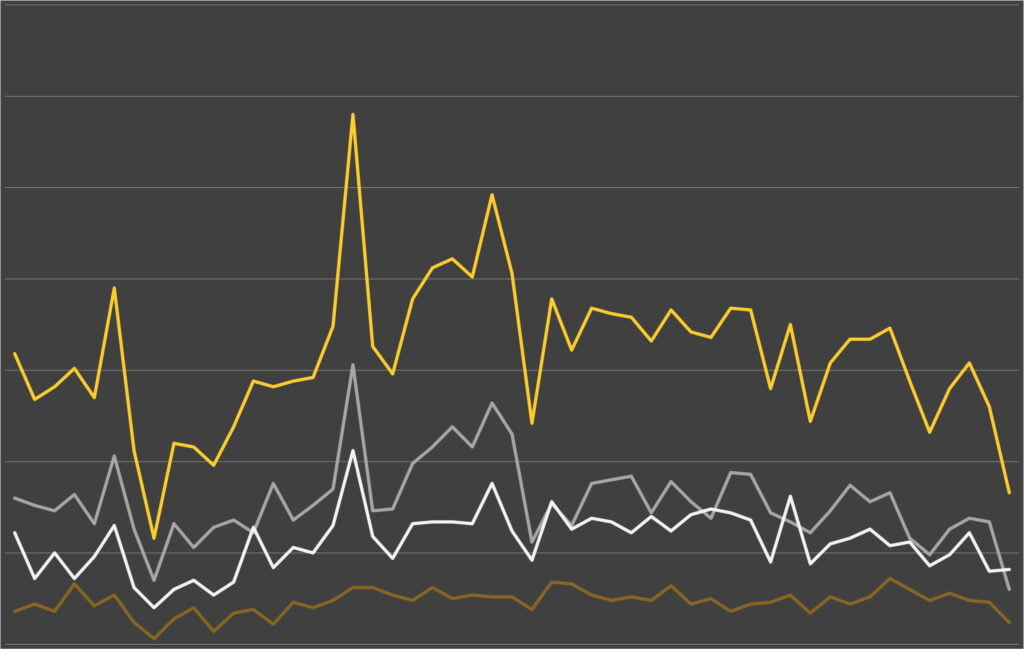

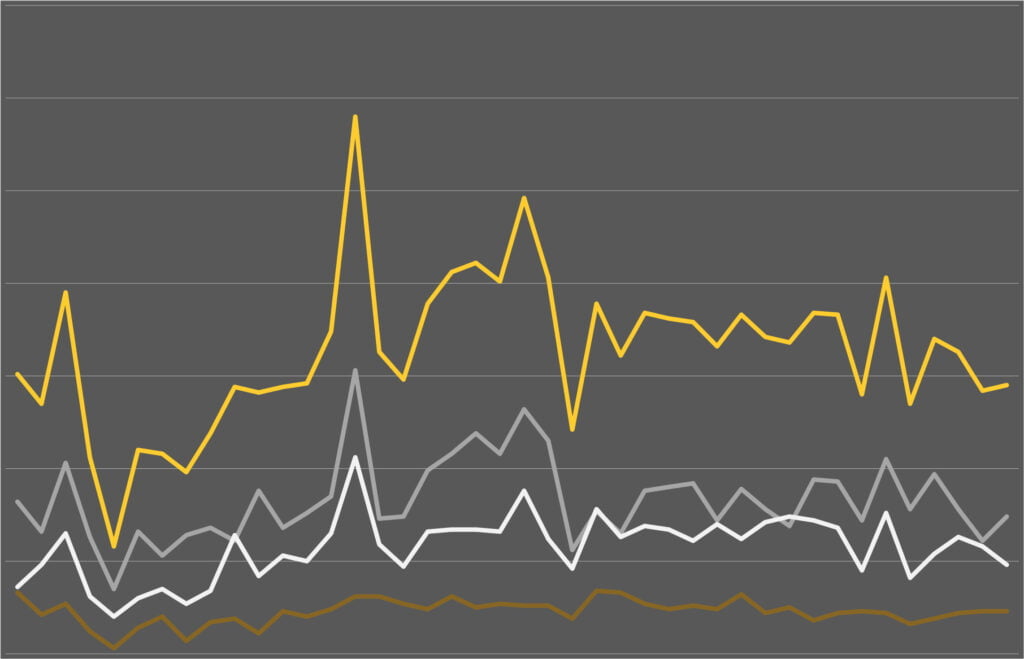

The UK Office for National Statistics have just released their latest statistics for Q4 2023. Below is the update on...

Deferred consideration vs earn-out: This article exlains the key differences… When selling a company, the negotiation and structuring of the...

The choice between a locked box mechanism and a completion accounts mechanism is a crucial decision in mergers and acquisitions...

The UK Office for National Statistics have just released their latest statistics for Q3 2023. Below is the update on...

Most private company owners are aware of ‘Deal Multiples’ – the idea that a multiple of profit, or EBITDA, becoming...