Latest UK M&A Statistics for Q3-24

The UK Office for National Statistics have just released their latest statistics for Q3 2024. Below is the update on Mergers and Acquisitions (M&A) involving UK companies for Q3 2024, during the period July to September 2024.

Please note that these include only transactions that result in a change of ultimate control of the target company and have a value of £1M or more. Also numbers are provisional and may be subject to revisions in either direction, but are more likely to be upwards than downwards.

Headline Statistics for UK M&A Q3 2024

In Q3-24, total number of mergers and acquisitions (M&A) was 436, 43 fewer transactions than in the previous quarter (479).

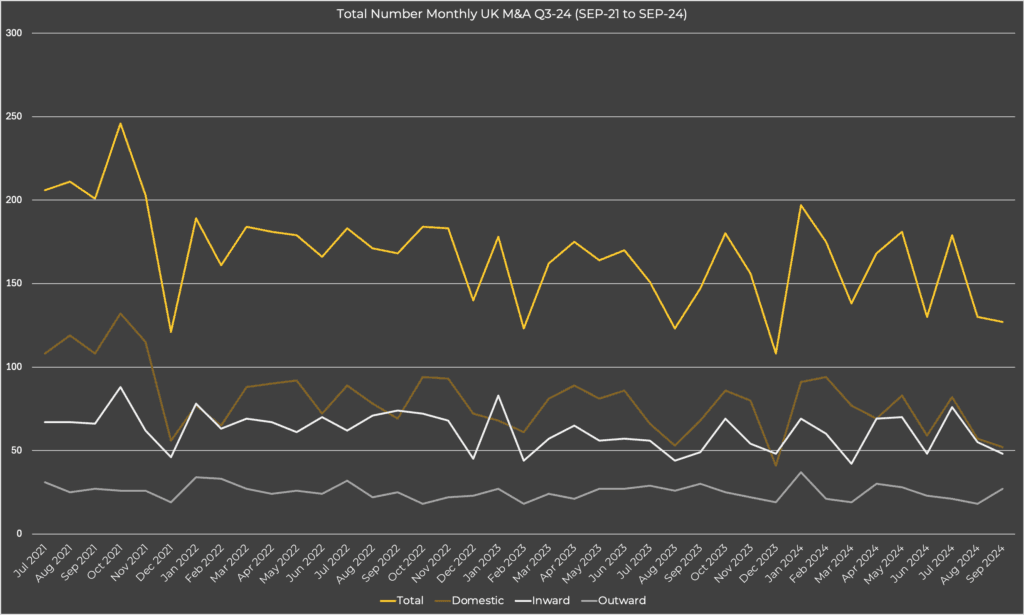

Monthly M&A saw a total of 179 in JUL-24, falling 49 to 130 in AUG-24, declining 3 further to 127 in SEP-24.

In Q3-24, value of inward M&A was £7.8Bn, £1.1Bn higher than the previous quarter (£6.7Bn).

Value of outward M&A in Q3-24 was £4.0Bn, £0.2Bn lower than the previous quarter (£4.2Bn).

Domestic M&A in Q3-2024 was £2.1Bn, £0.9Bn lower than the previous quarter (£3.0Bn).

Monthly UK M&A Q3-2024

Total (M&A) saw a notable increase in JULU-24 (179), falling sharply in AUG-24 (130), then decreasing further in SEP-24 (127). This was an all time low for all months since DEC-23.

Figure shows the total number of monthly domestic and cross-border M&A involving UK companies fell sharply between JUL and AUG-24

The total number of monthly domestic and cross-border mergers and acquisitions involving UK companies from July 2021 to September 2024 ranged from 108 to 246.

The total number of monthly domestic and cross-border mergers and acquisitions involving UK companies from July 2021 to September 2024 ranged from 108 to 246.

Domestic monthly UK M&A was 82 transactions JUL-24, decreasing to 57 AUG-24, then falling again to 52 in SEP-24.

Outward monthly UK M&A saw a small decline in the numbers between JUL-24 (21) and AUG-24 (18) before increasing to 27 SEP-24.

Inward monthly UK M&A was 76 acquisitions JUL-24 falling to 55 AUG-24 and 48 SEP-24.

The Bank of England’s summary of business conditions for Q3-24 reported that:

Overall, investment intentions continue to gradually improve and are positive for the year ahead, though there are some for whom the outlook remains highly uncertain. Professional services firms report steady revenue growth driven by reasonable, but weakening, fee growth and modest, but rising, volume growth, as some corporate transactions, such as mergers and acquisitions, have increased slightly. While this means some increase in the demand for funding, overall corporate financing activity remains flat on a year ago.

The same report stated that:

Competition continues among banks to lend to the most creditworthy businesses. Contacts report there is greater willingness to lend to businesses for investment purposes, given an improved economic outlook. Mainstream banks are showing greater appetite for mid-market lending and there are signs of rising mid-market private equity activity and of more appetite for tech and early-stage finance, from a low base. Access to credit is still a challenge for small and medium enterprises and remains difficult for firms with high debt, low profitability or limited security.

Inward UK M&A Q3-24

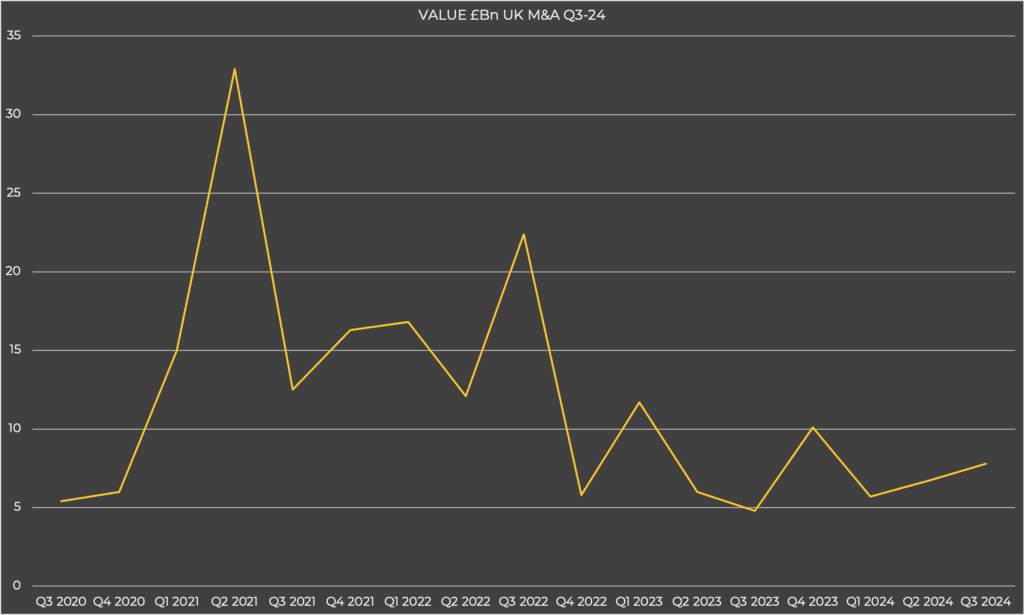

Value Inward UK M&A Q3-24

Value inward M&A in Q3-24 increased to £7.8Bn, an increase of £1.1Bn compared with the previous quarter (£6.7Bn) and £3.0Bn more than Q3-23 (£4.8Bn).

A notable inward acquisition that completed in Q3-24, was the acquisition of Tyman Plc of the UK by Quanex building products corporation of the US.

Value of inward M&A between Q3-20 and Q3-24 ranged from £4.8Bn to £32.9Bn, and increased to 7.8Bn in Q3-24.

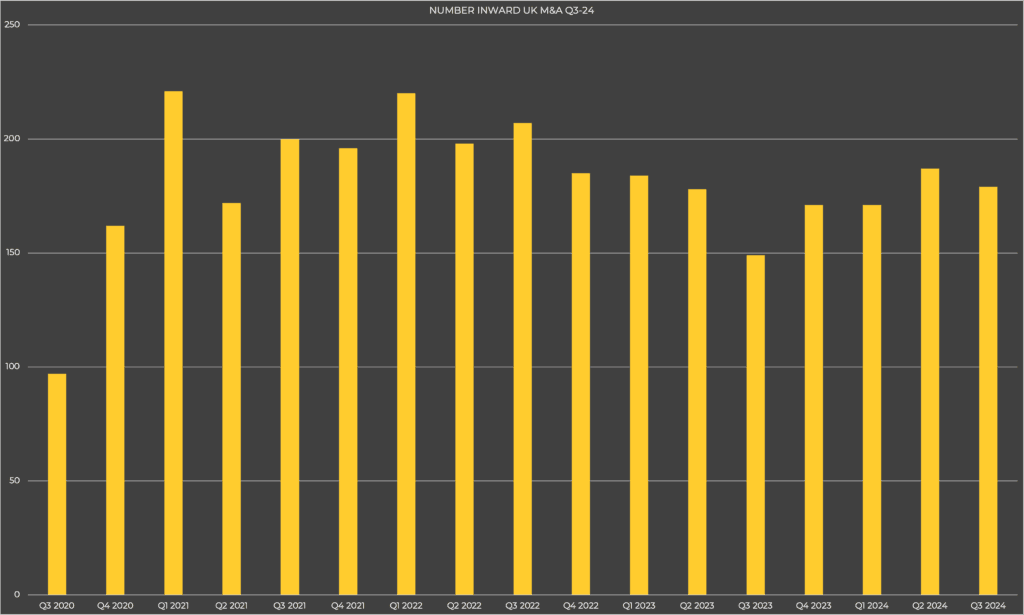

Number Inward UK M&A Q3-24

Inward M&A transactions in Q3-24 were 179, a small decrease of 8 on the previous quarter (187) & 30 more than Q3-23 (149).

Total number of inward M&A acquisitions between Q3-20 and Q3-24 ranged from 97 to 221.

Outward UK M&A Q3-24

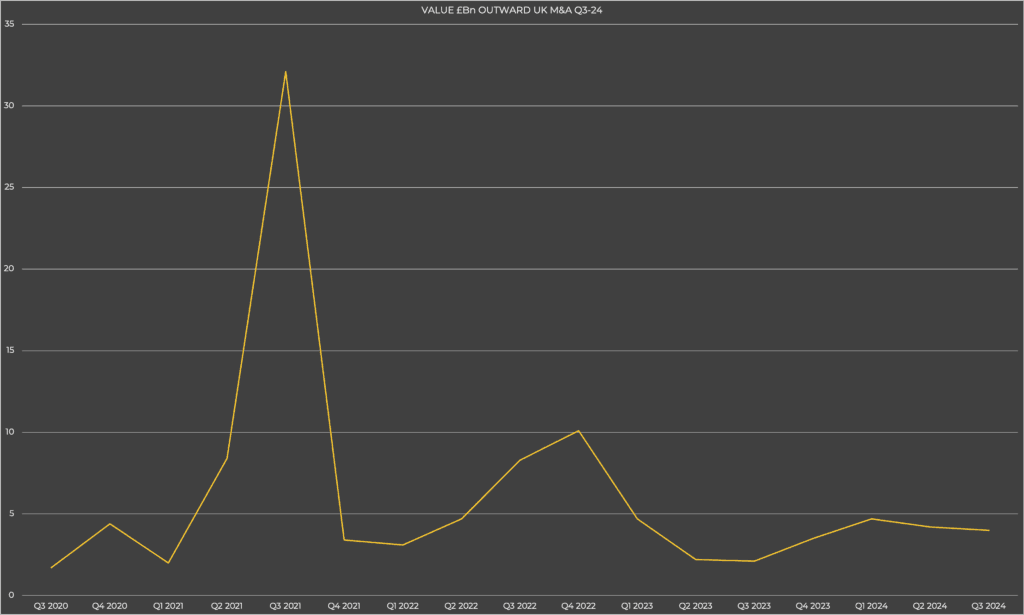

Value Outward UK M&A Q3-24

Value of outward M&A in Q3-24 was £4.0Bn. This was £0.2Bn lower than in the previous quarter (£4.2Bn) and £1.9Bn higher than Q3-23 (£2.1Bn).

One notable outward acquisition that completed in Q3-24 was the acquisition of Amolyt Pharma SAS of France by AstraZeneca Plc.

Value outward M&A ranged from £1.7Bn to £32.1Bn between Q3-20 and Q3-24 and remained largely consistent between Q2-24 and Q3-24.

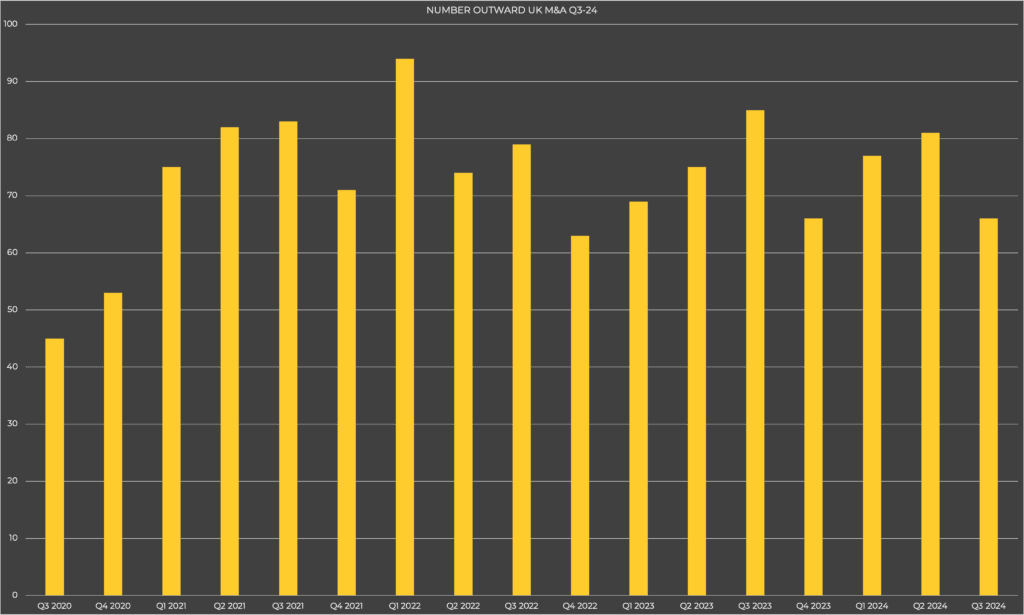

Number Outward UK M&A Q3-24

There were 66 outward acquisitions in Q3-24, 15 fewer than in the previous quarter (81) and 19 fewer than Q3-23 (85).

Total number of outward M&A between Q3-20 and Q3-24 ranged from 45 to 94 transactions and decreased to 66, from 81 in previous quarter.

Domestic UK M&A Q3-24

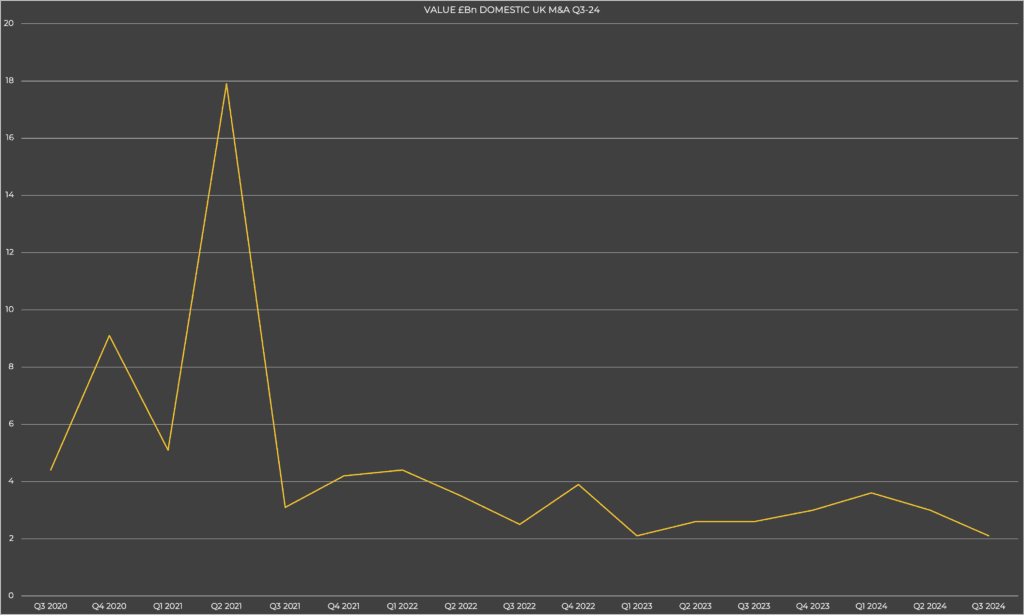

Value Domestic UK M&A Q3-24

Value of domestic M&A in Q3-24 was £2.1Bn, £0.9Bn less than previous quarter and £0.5Bn less than Q3-23 (also £2.6Bn).

Value of domestic M&A between Q3-20 and Q3-24 ranged from £2.1Bn to £17.9Bn.

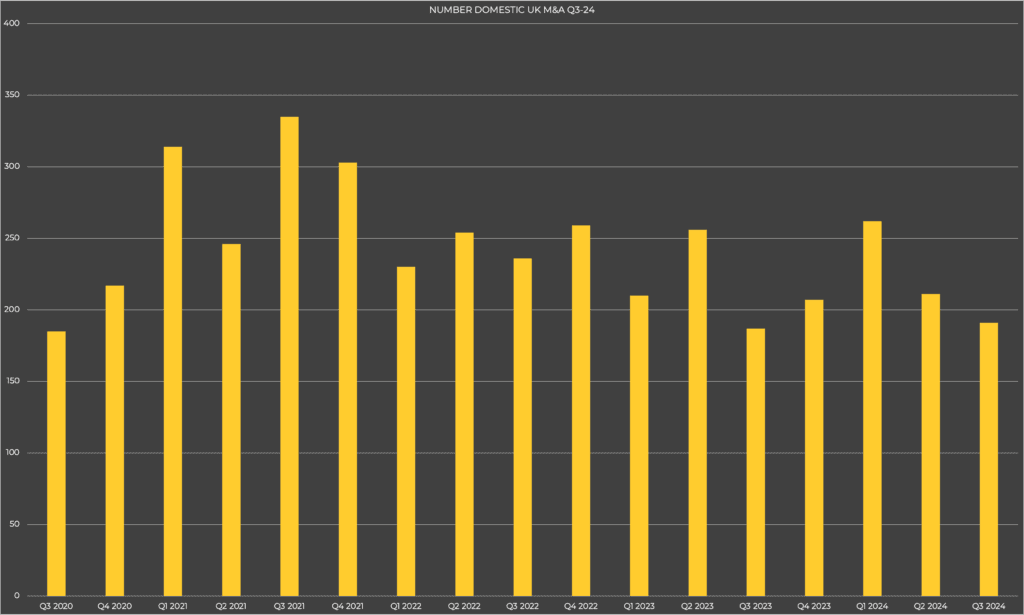

Number Domestic UK M&A Q3-24

Domestic M&A was 191 during Q3-24, 20 less than previous quarter (211) & 4 less than in Q3-23 (187).

Total number of domestic M&A between Q3-20 and Q3-24 ranged from 185 to 335, falling to 191.

he above data for M&A Statistics for Q3-24 was extracted from the Office of National Statistics; full details here.

Do you want to know how the latest UK M&A statistics for Q3-24 are relevant to your company sale? Then contact us now for a confidential appraisal of potential market appetite for your industry.

Tags: M&A Statistics, M&A Stats, Office for National Statistics, Q3 2024, Q3-24, UK