Latest UK M&A Statistics for Q4 2022

The UK Office for National Statistics have just released their latest statistics for Q4 2022. Below is the update on Mergers and Acquisitions (M&A) involving UK companies for Q4 2022, during the period October to December 2022.

Please note that these include only transactions that result in a change of ultimate control of the target company and have a value of £1M or more.

Headline Statistics for UK M&A Q4 2022

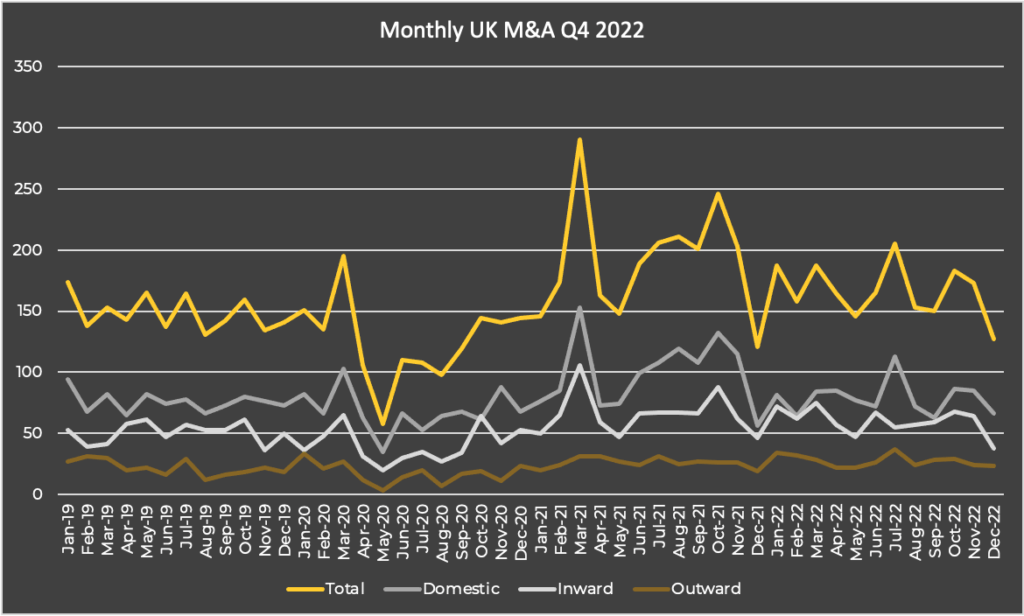

Total number of monthly M&A decreased slightly between October 2022 (total 183) and November 2022 (173), then fell sharply to 127 in December 2022.

Value of outward M&A in Q4 2022 was £10.1Bn, up £2.5Bn from Q3 2022 (£7.6Bn) and £6.7Bn higher than in the same period the previous year (£3.4Bn).

Value of inward M&A in Q4 2022 was £5.3Bn, £15.9Bn lower than Q3 2022 (£21.2Bn) and £11.0Bn less than in the same period the previous year (£16.3 billion). Although the value of inward M&A fell from Q3 to Q4 2022, the number of transactions remained consistent.

Value of domestic M&A was £3.6Bn in Q4-22, £1.7Bn higher than in Q3 2022 (£1.9Bn), but £0.6Bn lower than in the same period the previous year (£4.2Bn).

Monthly UK M&A Q4 2022

Monthly UK M&A restored its previous level of activity since being adversely hit by Covid-19 in 2020. More recently it has been affected by the Russian invasion of Ukraine which has increased economic uncertainty and therefore confidence.

Monthly outward M&A consistently fell slightly each month during Q4 2022, with 29 transactions in October, 24 in November and 23 in December 2022.

The number of monthly inward M&A transactions was consistent between October (68) and November (64), but dropped slightly to 38 transactions during December 2022.

Domestic monthly M&A transactions, likewise, saw consistent numbers between October (86) and November (85), before decreasing significantly to 66 transactions during December 2022.

The Bank of England’s Agents’ summary of business conditions for Q4 2022 reported that

Tighter financial conditions, market volatility and weaker confidence, had weighed on corporate transaction activity, such as mergers and acquisitions, commercial property transactions and private equity deals… for companies that borrow to invest, higher funding costs had increased the uncertainty around investment plans by extending the payback period on projects. And rising costs continued to deter building-related investment. A number of contacts said that they had less cash available for investment because they had been obliged to build up stocks in order to manage supply-chain disruption. Many contacts reported that higher energy costs had incentivised investment in energy efficiency or power generation, though for some the increased cost had deterred investment.

The Bank of England

Outward UK M&A Q4 2022

In Q4 2022, the total value of outward M&A increased to £10.1Bn. This is an increase of £2.5Bn compared with the Q3 2022 (£7.6Bn), and significantly higher (almost three times) than in the same period for the previous year, £3.4Bn.

Two notable outward acquisitions in Q4 2022 were the acquisition in October of Terminix Global Holdings Inc of the USA by Rentokil Initial Plc of the UK, and the acquisition completed in December of Archaea Energy Inc of the USA by BP Plc of the UK.

Value Outward UK M&A Q4 2022

The value of outward M&A between Q4 2018 and Q4 2022 ranged from £1.7Bn to £32.1Bn.

Number Outward UK M&A Q4 2022

There were 76 completions for outward M&A in Q4 2022, a decrease of 13 from Q3 2022 (89) and five more than in the same period of the previous year (71).

The number of outward M&A transactions between Q4 2018 and Q4 2022 ranged from 30 to 94 transactions.

Inward UK M&A Q4 2022

Value Inward UK M&A Q4 2022

The value of inward M&A between Q4 2018 and Q4 2022 ranged from £2.8Bn to £38.8Bn.

Number Inward UK M&A Q4 2022

There were 170 inward acquisitions in Q4 2022, one less than in Q3 2022 (171) and 26 fewer than in the same period of 2021 (196).

The number of inward M&A between Q4 2018 and Q4 2022 ranged from 81 to 221 transactions.

Domestic UK M&A Q4 2022

Value Domestic UK M&A Q4 2022

The value of domestic M&A in Q4 2022 was £3.6Bn. This is a £1.7Bn increase from Q3 2022 (£1.9Bn), but £0.6Bn less than in the same period for the previous year (£4.2Bn).

The value of domestic M&A between Q4 2018 and Q4 2022 ranged from £0.9Bn to £17.9Bn.

Number Domestic UK M&A Q4 2022

There were 237 domestic M&A deals during Q4 2022, 11 less than in Q3 2022 (248) and 66 fewer than in the same period for the previous year (303).

The number of domestic M&A between Q4 2018 and Q4 2022 ranged from 164 to 335 transactions.

The above data for M&A Statistics for Q4 2022 was extracted from the Office of National Statistics; full details here.

Do you want to know how the latest UK M&A statistics for Q4 2022 are relevant to your company sale? Then contact us now for a confidential appraisal of potential market appetite for your company sale.

Tags: M&A Statistics, M&A Stats, Office for National Statistics, Q4 2022, UK