Latest UK M&A Statistics for Q4-24

The UK Office for National Statistics have just released their latest statistics for Q4-24. Below is the update on Mergers and Acquisitions (M&A) involving UK companies for Q4 2024, during the period October to December 2024.

Please note that these include only transactions that result in a change of ultimate control of the target company and have a value of £1M or more. Also numbers are provisional and may be subject to revisions in either direction, but are more likely to be upwards than downwards.

Headline Statistics for UK M&A Q4-24

In Q4-24, total number of mergers and acquisitions (M&A) was 402, 62 fewer transactions than in the previous quarter (464).

Monthly M&A saw a total of 186 in OCT-24, falling 35 to 151 in NOV-24, declining a further 86 to 65 in DEC-24.

Value of inward M&A Q4-24, was £4.5Bn, £5.9Bn lower than the previous quarter (£10.4Bn).

Value of outward M&A in Q4-24 was £1.4Bn, £2.5Bn lower than the previous quarter (£3.9Bn).

Domestic M&A in Q4-2024 was £8.6Bn, an increase of £6.7Bn than for the previous quarter (£1.9Bn).

Monthly Total UK M&A Q4-24

Total (M&A) saw a notable decrease between OCT-24 (186) and NOV-24 (151) falling further in DEC-24 (65).

Figure 1: The total number of monthly domestic and cross-border M&A involving UK companies fell across the quarter SEP-24 to DEC-24, following a high figure for OCT-24

The total number of monthly M&A involving UK companies from October 2021 to December 2024 ranged from 65 to 246.

Figure shows total number of monthly M&A involving UK companies from October 2021 to December 2024 ranged from 65 to 246.

Domestic monthly UK M&A was 92 transactions OCT-24, decreasing to 78 NOV-24 and 32 DEC-24.

Outward monthly UK M&A saw a small decline in the numbers between OCT-24 (30) and NOV-24 (26) before facing further DEC-24 (11).

Inward monthly UK M&A was 64 acquisitions OCT-24 falling to 47 NOV-24 and 22 DEC-24.

The Bank of England’s summary of business conditions for Q4-24 reported that:

“Investment intentions remain subdued, with a marginal balance towards increasing investment in the coming year. Many contacts express a general sense of uncertainty and caution driven by a mix of factors, such as uncertainty about demand, high borrowing costs, higher capital expenditure costs, squeezed margins and access to finance. There was limited reference to the Budget having a direct impact on investment plans at this stage”

The same report stated that:

“the supply of credit is tighter than pre-pandemic for small firms but seems not to be a concern for large firms. High interest rates and weak activity continue to suppress overall demand for credit. Banks continue to compete to lend to the most creditworthy firms and their appetite to lend to sectors previously considered vulnerable is increasing. Small and medium sized firms find secondary lenders easier to access as many cannot meet major banks’ credit criteria. Start-up and early-stage companies continue to struggle to source growth finance”.

Domestic UK M&A Q4-24

Value Domestic UK M&A Q4-24

Value of domestic M&A in Q4-24 was £8.6Bn, an increase of £6.7Bn from previous quarter (£1.9Bn) and £3.7Bn more than Q4-23 (also £17.9Bn). Value levels for domestic M&A Q4-24 were highest since Q2-21 (£17.9Bn).

Value of domestic M&A between Q4-20 and Q4-24 ranged from £1.9Bn to £17.9Bn.

Two notable completed domestic M&A in Q4-24 were:

- Virgin Money UK Plc acquired by Nationwide Building Society

- Redrow Plc acquired by Barratt Developments Plc

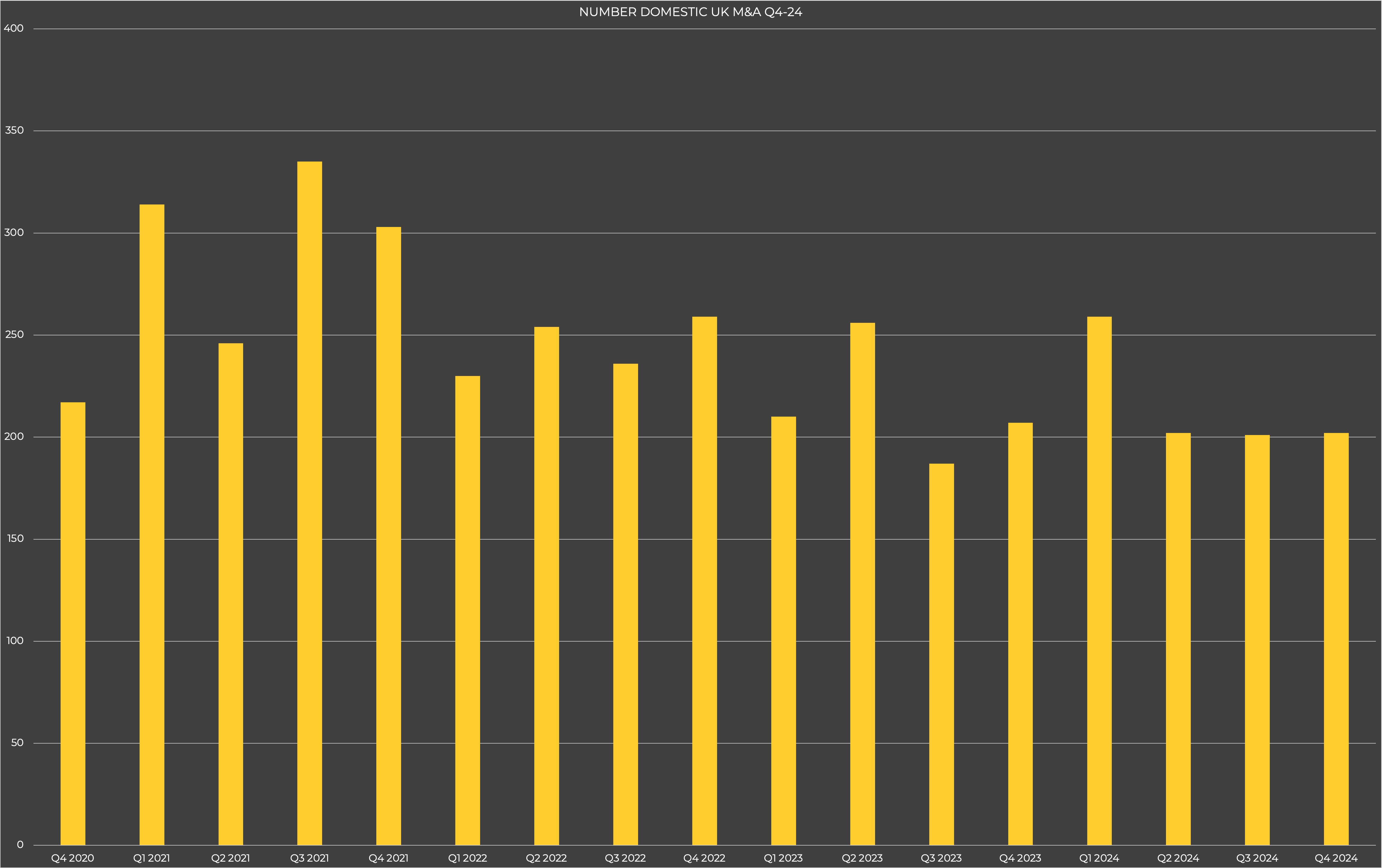

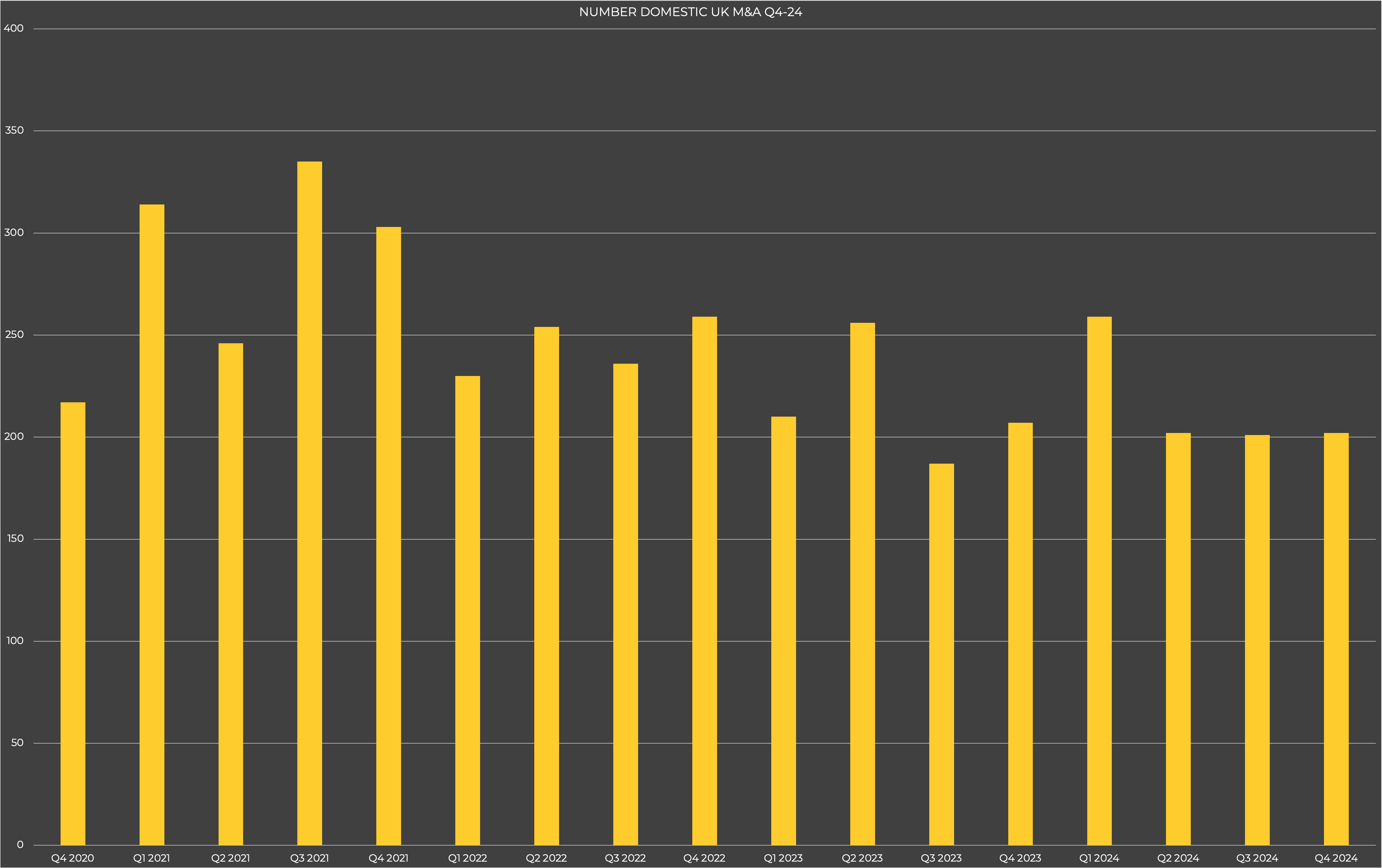

Number Domestic UK M&A Q4-24

Domestic M&A was 202 during Q4-24, similar to previous quarter (201) & Q4-23 (207).

Total number of domestic M&A between Q4-20 and Q4-24 ranged from 187 to 335.

Outward UK M&A Q4-24

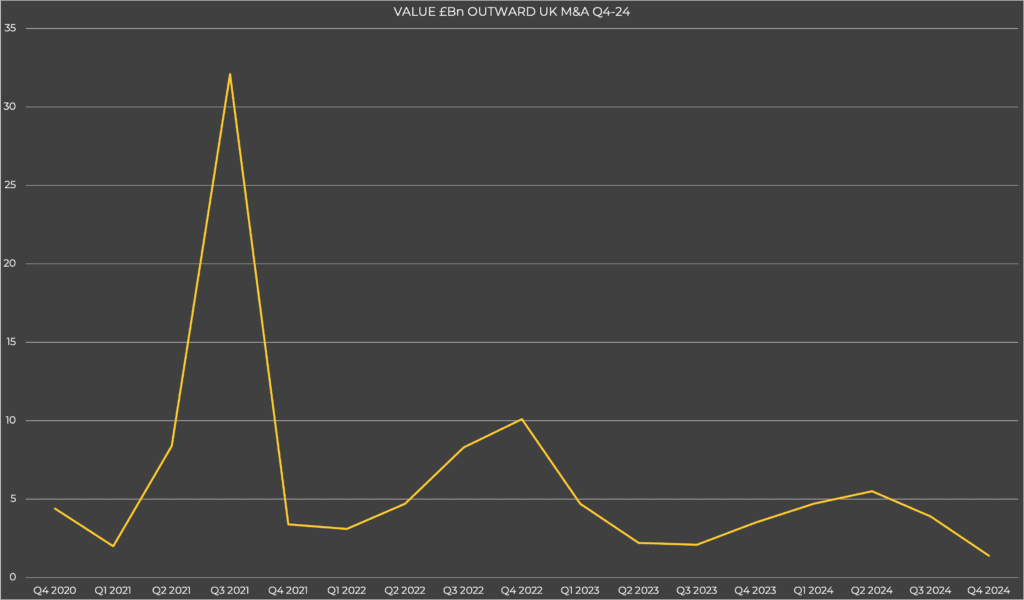

Value £Bn Outward UK M&A Q4-24

Value of outward M&A in Q4-24 was £1.4Bn. This was £2.5Bn lower than in the previous quarter (£3.9Bn) and £2.1Bn lower than Q4-23 (£1.4Bn), lowest since Q3-13 (£0.5Bn).

Value outward M&A ranged from £1.4Bn to £32.1Bn between Q4-20 and Q4-24.

Number Outward UK M&A Q4-24

There were 67 outward acquisitions in Q4-24, 3 fewer than in the previous quarter (70) and 1 more than Q4-23 (66).

Figure 5: NUMBER OUTWARD UK M&A Q4-24

Total number of outward M&A between Q4-20 and Q4-24 ranged from 53 to 112 transactions.

Inward UK M&A Q4-24

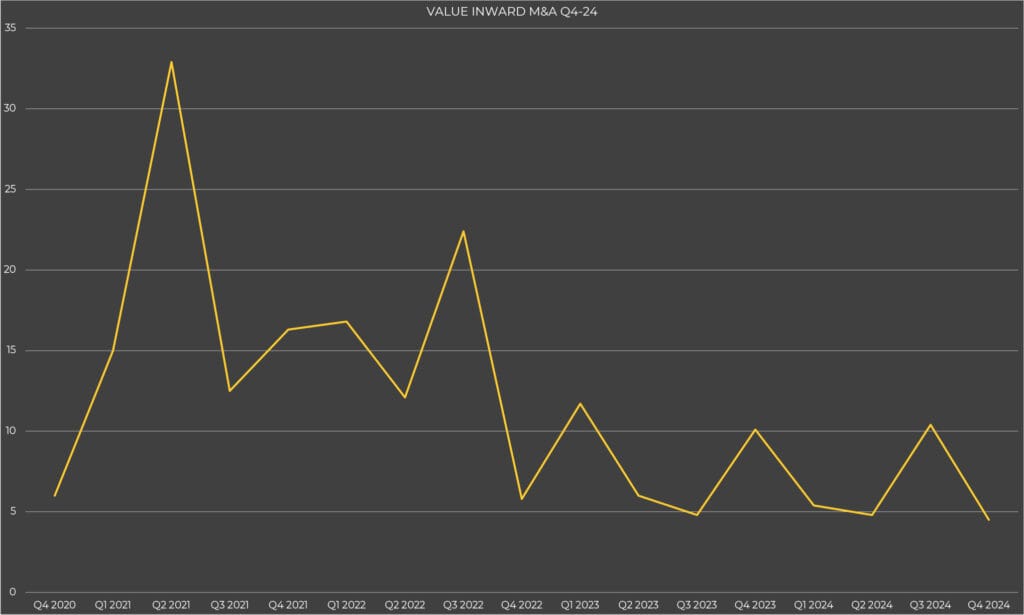

Value Inward UK M&A Q4-24

Value inward M&A in Q4-24 declined sharply to £4.5Bn, £5.9Bn less than previous quarter (£10.4Bn) and £5.6Bn less than Q4-23 (£10.1Bn).

Value of inward M&A between Q4-20 and Q4-24 ranged from £4.5Bn to £32.9Bn.

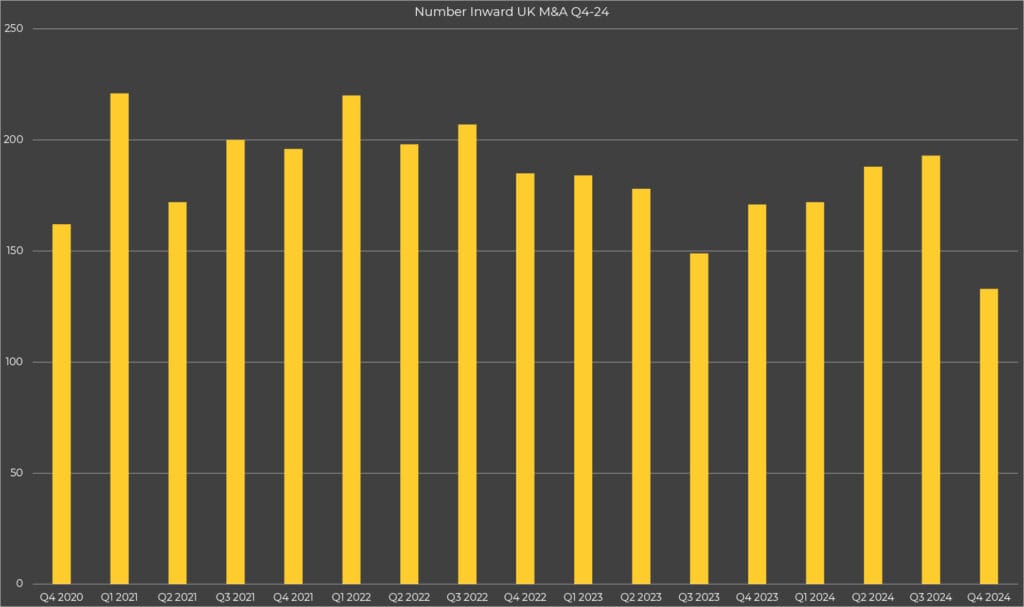

Number Inward UK M&A Q4-24

Inward M&A transactions in Q4-24 were 133, 60 fewer than previous quarter (193) & 38 fewer than Q4-23 (171).

Total number of inward M&A acquisitions between Q3-20 and Q3-24 ranged from 97 to 221.

The above data for M&A Statistics for Q4-24 was extracted from the Office of National Statistics; full details here.

Want to know how the latest UK M&A statistics for Q4-24 are relevant to your company sale, then contact us now for a confidential appraisal of potential market appetite for your industry.

Tags: M&A, Office for National Statistics, Q4 2024, Q4-24, Statistics, Stats, UK